Give a Winning Investor Presentation – Top 10 Tips

July 14, 2024

Presenting to investors may feel daunting. But at the same time it’s a great opportunity.

One of your biggest challenges when you present to investors is knowing at what level to present. do you need to outline the background should you cover all the detail do you need to address every objection .

The most important thing to understand is that investors want to understand; they don’t want a slick pitch . They do not want to mark your homework; they want to make decisions based on what you say. Whether you are raising money, updating investors, running results presentations or producing a capital markets day, these tips will help you create better presentations for investors.

Presenting to investors is a real skill. A core skill for entrepreneurs and leaders. And it’s a skill you can learn. Over the last 15 years we’ve coached thousands of people to be brilliant at presenting to investors.

Do please call us and we’ll tell you about our investor presentation coaching – it’s fast and good value.

To help you master the skills of a high-stakes investor presentation, our coaches have shared their top ten lessons for creating and delivering winning investor presentations. Their advice is based on over 15 years of successfully coaching businesses globally.

Get a free consultation about your coaching needs now

Top ten tips for presenting to investors

Let’s review each of these tips in more detail:

1. Investors wants to learn, not hear a series of data points

Imagine. As an investor you have huge responsibilities. You need to make decisions based on limited knowledge. And your performance is based on these decisions. When someone presents, you want to know that you are listening to someone who can make money for investors. You want them to explain clearly how they will make money. What you don’t want is someone who gives a slick presentation with no substance.

When presenting to investors, you need to do the hard work for the investor so that your presentation to investors lays out clearly what the issues are, why they are important and what you are doing about it. If you are very good you will also look at alternative approaches and argue why those will not work. You may also assess risks.

By taking this approach you show that you understand the issues and that the investor can rely on your good judgement.

2. Keep your investor presentation concise

Most investors and analysts are very busy and have a huge amount on their plate. When presenting to investors your job is to make it easy for the investor to make a decision . You’ll find that you will be most successful if you say less, and say it better. What do I mean by that? Don’t waste time stating the obvious. You do not need to tell them that climate change is a big issue or that AI is a growing trend.

You will look more impressive when you present if you build on the investor’s existing knowledge rather them telling them stuff they know already. A short, concise presentation is also easier to understand

3. Your investor presentation must get to the point quickly

What do you say in the opening words of your high-stakes presentations? How do you grab attention and show that what you are saying will be valuable to the investor? If you want to impress you want to quickly lay out why you are there and what you are looking for from the investor.

The quicker you get to the meat of the topic the better. Do not start with extensive background and never leave the punchline until your closing words.

Make sure, at the very start of your presentation that your investor understands what you do, why you are successful and what you are doing to continue growing your business.

Only bad presentations leave the important information to the end.

Another way to make your investor feel comfortable is to start by talking about things in which they believe. For example, if you start your presentation by stating that the world is flat, you will alienate most people. Instead, you want to get your investor nodding along with you towards the start of your presentation – so long as you are not stating the obvious.

4. Know what your investor needs to hear

Presenting to investors is very different from presenting to customers. They need to hear different things. They don’t need to know how brilliant your product or service is, they need to know how you will grow your business. To get the result you want, you should talk to investors in the way they want to be spoken to. That means using the language of investors. Do you speak about the cost of acquiring each customer, the lifetime value of a customer, or your KPIs? How do you talk about the competition and your competitive advantages?

These are the sort of questions you want to address in your presentation. If you tell your investor the things that they need to know, you’ll make their job easier and they will feel better about the potential of investing.

For example, one client recently was presenting to investors to raise money to grow their business. The CEO was brilliant at pitching the product, but was less comfortable speaking the language that investors would expect. With our coaching and our help re-writing the investor pitch, the investment story became clearer and they eventually raised £8m from investors to grow their business.

5. Build your relationship first, the investment second

While you may think of investment decisions as dry and calculated, emotion plays a large part in the decision making process. In reality, the biggest investment decisions are based on a gut reaction and only justified by a logical analysis. This means you should use your meeting to build a good relationship with your investor.

For example, you should ask your investor questions during your investor meeting. Why? Because by showing interest in the investor, you build a relationship. You also learn about what the investor needs and wants.

If people have raised objections before the meeting, then address those objections in your presentation. People want to be heard and appreciated.

6. You are the expert when presenting to investors

While many investors may be strong, daunting figures, they are unlikely to be experts in your specialist area. You are presenting because you have expertise . If you don’t know more than them, then you are not the right person to be presenting, or you are looking at the wrong thing. You should be educating the investors – they should learn from you.

7. Minimise use of visual aids in investor presentations

You can waste a huge amount of time preparing PowerPoint. But too many PowerPoint slides will reduce your impact in investor presentations . Instead, put your efforts into a high-quality story and a powerful interactive meeting.

Some things you should work on for your next investor presentation:

– Use language that makes your investor comfortable. For example, what’s most important to them? Is it sales, profits, growth rates, margins, safety, cash flow? Talk about what matters to them.

– What metaphors do they use ? Do they talk about driving the business? Do they talk about nurturing and growing the company? Or do they talk about battling the competition and fighting market conditions? When you use the investor’s own favourite metaphors, you will be speaking their language.

8. Use stories and examples when presenting to investors

One of my favourite sayings for pitches and presentations is: “Facts get forgotten, but stories get repeated”. A good story is usually more compelling than the most convincing numbers. Yet too many investor presentations fail to apply the power of a compelling story.

A good story in your investor presentation can be a multi-tool. It can do many jobs at once. A powerful story can help bring to life a complex idea. A story can make it easy for an investor to understand what drives your business and a strong story will give the investor something they will remember and repeat to their colleagues.

We’ve written a few good articles on how to use business storytelling and this is one of my favourites .

9. Make your investor presentation easy and fun

One common mistake when presenting to investors is to make your presentation too long and too complicated. Just because you are smart and your investors are smart does not mean that your investor presentation needs to show how much work you have done. Complexity is off-putting. The human brain loves simplicity . An investor presentation should be made simple for your audience.

Having worked on hundreds of successful investor presentations, we are often surprised how simple the best presentations are. But turning complex presentations into simple presentations is hard. Anybody can fill a presentation with detail. It takes real skill to convince your investor with just a handful of smart ideas and cast-iron logic.

10. Prepare your investor presentation rigorously

Test your presentation on other people. Show it to your colleagues. Ask people to pick holes in your arguments. Be tough on yourself. Keep working at it and fixing it until you are completely happy. And practise it out loud. Not to memorise it, but to check if it is good enough. And make sure you look good as a team. The investor will be judging all of you, individually AND how you interact.

For you to be successful in your investor presentations, you want to be well prepared. Many people bring in a coach to help them prepare. That way you can stress-test your ideas, rehearse and improve your presentation , then go into the investor meeting feeling confident that you are ready.

How do you do this? Call us. We spend our lives polishing investor presentations.

How to be brilliant at investor presentations

Get some expert help. if you want to really impress when you next pitch to investors, then get in touch. we’ve been helping businesses present to investors for over 15 years. hundreds of businesses have benefitted from our fast and efficient coaching expertise., call louise angus, our client services director, for a no-obligation chat about how we can add value to your investor presentation., transform your pitches and presentation with tailored coaching.

We can help you present brilliantly. Thousands of people have benefitted from our tailored in-house coaching and advice – and we can help you too .

“I honestly thought it was the most valuable 3 hours I’ve spent with anyone in a long time.” Mick May, CEO, Blue Sky

For 15+ years we’ve been the trusted choice for leading businesses and executives throughout the UK, Europe and the Middle East to improve corporate presentations through presentation coaching, public speaking training and expert advice on pitching to investors.

Some recent clients

Unlock your full potential and take your presentations to the next level with Benjamin Ball Associates.

Speak to Louise on +44 20 7018 0922 or email [email protected] to transform your speeches, pitches and presentations.

or read another article...

Best message house template, benefits, examples, and more.

What is a message house? How do you use a message house in…

Why Your Hedge Fund Pitch Deck Matters (& How to Create It)

Are you writing a hedge fund investor presentation? Do you want to improve…

What Investors Look For In A Pitch Deck

Are you a business looking to raise money? Are you writing an investor…

12 Investor Presentation Mistakes and How to Avoid Them

What mistakes do people make in investor presentations? How do you avoid these…

Contact us for a chat about how we can help you with your presenting.

What leaders say about Benjamin Ball Associates

Coo, northpeak.

Whenever I need help with public speaking or presentations, Ben is always the first person I call. His advice and guidance have been invaluable, helping me refine my ideas and deliver them with confidence. Ben’s ability to break down complex concepts and offer actionable feedback is truly unmatched. He’s not just a great communicator himself, but also an incredible mentor who inspires others to excel. I can’t recommend Ben highly enough for his expertise and support!

Chelsea Hayes, COO, NorthPeak Resources

I’ve had the pleasure of working with Paul Farrow on several occasions, and every time, I am reminded of his incredible ability to tailor media training to the unique needs of each stakeholder. Whether it’s someone with years of experience or a beginner taking their first steps as a spokesperson, Paul ensures that every participant feels confident and prepared to tackle their specific communication challenges. What sets Paul apart is his thoughtfulness and kindness in every interaction. He not only delivers valuable insights but also works seamlessly with the communications team to ensure the training is both impactful and aligned with broader goals. The results speak for themselves — participants consistently show clear improvement and feel empowered to take on their roles as effective speakers. Even during long Zoom sessions, Paul manages to keep the energy high and the experience enjoyable for everyone involved. His collaborative and engaging approach makes the training not only productive but genuinely enjoyable. I would highly recommend Paul to anyone looking for a media trainer who delivers results, works with empathy, and truly understands how to bring out the best in every participant.

Mayra Gasparini Martins, Wise

Ceo, plunkett uk.

"Thank you so much for an absolutely brilliant session yesterday! It was exactly what we were hoping for, and you did an incredibly job covering such a range of issues with four very different people in such short a session. It really was fantastic - thank you!"

James Alcock, Chief Executive, Plunkett UK

Manager, ubs.

"Essential if you are going to be a spokesperson for your business"

Senior Analyst, Sloane Robinson

"Being an effective communicator is essential to get your stock ideas across. This course is exactly what's needed to help you do just that!"

CEO, Blast! Films

“Our investment in the coaching has paid for itself many times over.”

Ed Coulthard

Corporate finance house.

“You address 95% of the issues in a quarter of the time of your competitor.”

Partner International

“Good insight and a great toolbox to improve on my presentations and delivery of messages to not only boards, analysts and shareholders but to all audiences”

CEO, Eurocamp

“We had a good story to tell, but you helped us deliver it more coherently and more positively.”

Steve Whitfield

Let's talk about your presentation training needs, +44 20 7018 0922, [email protected], our bespoke presentation coaching services, investor pitch coaching, executive presentation coaching, public speaking training, executive media training, new business pitch coaching, privacy overview.

Best Practices for Creating a Top-Notch Investment Presentation for Investors

Raising venture capital is challenging, especially for early-stage startups. To attract investors, you need an exceptional investment presentation that effectively communicates your company’s vision, strategy, and potential. Inevitably, you will have to present or pitch to investors during a fundraise (typically using a pitch deck ). An investment presentation, also known as a business presentation for investors, is crucial for sharing your company narrative, showcasing your business model, and convincing investors why they should invest in your venture.

Creating a compelling investment presentation involves more than good storytelling; it requires a well-structured approach highlighting your company’s strengths, market opportunities, and financial projections. This guide covers best practices for creating a top-notch investment presentation, including templates, examples, and critical elements to include for a successful presentation for investors. Whether you are preparing for a seed round, Series A, or beyond, these insights will help you craft a presentation that captures investor interest and secures the funding you need.

Related resource: 11 Presentation Design Trends for Startup Pitch Decks in 2024

What is an Investment Presentation?

An investment presentation, often called a pitch deck, is a strategic tool startups and businesses use to communicate their vision, business model, market opportunity, and financial projections to potential investors. It is designed to persuade investors to fund the company by clearly articulating the value proposition and growth potential.

An investment presentation is more than just a set of slides; it's a powerful tool for storytelling and persuasion. As you prepare your investment presentation, focus on clarity, conciseness, and compelling content to make a lasting impact on your potential investors.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Purpose of an Investment Presentation

The primary purpose of an investment presentation is to secure funding from venture capitalists, angel investors, or other financial backers. It serves as a visual and narrative representation of your business plan, highlighting the most compelling aspects of your company to attract investor interest. Here are some key objectives:

- Communicate Your Vision: Present your company's mission, vision, and long-term goals.

- Showcase Your Team: Introduce the key team members, emphasizing their experience and capabilities.

- Explain the Problem and Solution: Define the market problem you are addressing and how your product or service solves it.

- Demonstrate Market Opportunity: Highlight your target market's size and growth potential.

- Outline Your Business Model: Explain how your company plans to make money and sustain growth.

- Present Financial Projections: Provide detailed financial forecasts, including revenue models, profit margins, and funding requirements.

- Illustrate Traction and Milestones: Show any progress or traction you have made, such as user growth, revenue milestones, or strategic partnerships.

Why is an Investment Presentation Crucial?

For startups and businesses seeking funding, an investment presentation is crucial for several reasons:

- First Impressions Matter: Often, this presentation is your first formal introduction to potential investors. A well-crafted presentation can make a solid first impression, setting the stage for further discussions.

- Storytelling and Persuasion: It allows you to tell your company's story compellingly, persuading investors of your business's viability and potential.

- Structured Communication: An investment presentation provides a structured format to present complex information clearly and concisely. This helps investors quickly understand your business and its potential.

- Highlighting Value Proposition: It highlights your unique value proposition, differentiating your company from competitors in the eyes of investors.

- Facilitating Due Diligence: A thorough and well-organized presentation can simplify the due diligence process for investors, making it easier for them to evaluate your business.

- Building Investor Confidence: By presenting well-researched data and realistic financial projections, you build confidence in your business acumen and readiness for investment.

Key Elements of an Investment Presentation

Creating an effective investment presentation involves including key elements that convey your company’s vision, strategy, and potential to investors. Here’s a detailed look at what to include and how to structure your presentation for maximum impact.

Related resource: How to Create Impactful Problem/Solution Slides for Your Pitch Deck

How to Present an Investment Opportunity

Presenting an investment opportunity to potential investors requires a blend of compelling storytelling, clear data, and strategic insights. Here are some tips to help you make a strong impression:

- Elevator Pitch: Begin with a concise and engaging elevator pitch that captures the essence of your business. This should be a brief overview that explains what your company does, the problem it solves, and why it’s unique.

- Hook Your Audience: Use a compelling story or statistic to grab the investors’ attention immediately.

- Problem Statement: Clearly articulate the problem your product or service addresses. Use real-world examples or data to illustrate the significance of this problem.

- Solution Description: Explain how your product or service effectively solves the problem. Highlight any unique features or innovations that set you apart from competitors.

- Market Size and Growth: Present data on your target market's size and growth potential. This demonstrates the scope of the opportunity and the potential for significant returns.

- Target Audience: Define your ideal customer and explain why your product is well-suited to meet their needs.

- Revenue Streams: Detail how your company makes money. Include different revenue streams, pricing strategies, and the scalability of your model.

- Business Strategy: Outline your go-to-market strategy, customer acquisition plans, and sales channels.

- Forecasts: Present realistic financial projections for the next 3-5 years. Include revenue, expenses, profit margins, and key financial metrics.

- Funding Requirements: Clearly state the amount of funding you are seeking, how it will be used, and the expected outcomes from this investment.

- Key Members: Highlight the key members of your team, emphasizing their relevant experience and expertise.

- Advisors and Partners: Mention any notable advisors, partners, or investors backing your company.

- Progress to Date: Share any significant achievements, such as user growth, revenue milestones, partnerships, or product developments.

- Future Milestones: Outline your roadmap and key milestones you plan to achieve with the new funding.

- Next Steps: Clearly state what you are asking from the investors and the next steps. Be confident and direct in your request for funding and support.

What is the purpose of an investment presentation?

An investment presentation or pitch is a tool to help founders share their company story and vision with investors. An investor presentation is a visual representation of your company narrative and includes things like metrics, roadmaps, team members, etc.

Kristian Andersen of High Alpha breaks down how founders should think about crafting their pitch deck and story below:

Related Resource: Tips for Creating an Investor Pitch Deck

How an Investment Presentation Fits into the Broader Category of Presentations for Investors

While all business presentations aim to communicate important information, an investment presentation is specifically tailored to attract financial backing. Here’s how it fits within the broader category of presentations for investors:

- Focus on Investment Opportunity: Unlike other business presentations that might focus on operational updates or strategic planning, an investment presentation is solely focused on showcasing the investment potential of your business.

- Detailed Financial Insights: Investment presentations require detailed financial forecasts and funding needs, which are typically more comprehensive than in other types of business presentations.

- Strategic Persuasion: The goal is to persuade investors of the viability and potential return on investment, necessitating a higher level of strategic storytelling and data-driven argumentation.

- Investor-Centric Approach: Tailored specifically to the interests and concerns of investors, these presentations address aspects like market opportunity, competitive landscape, and growth potential more deeply.

How Long Should an Investment Presentation Be?

The length of an investment presentation is crucial for maintaining investor interest and ensuring all key points are communicated effectively. While there is no one-size-fits-all answer, there are general guidelines that can help you determine the optimal length for your investment presentation.

Different businesses and pitches will require different pitch decks, but we have found that as a rule of thumb founders should shoot for a pitch deck that is 12 slides or less.

We studied our own data from our pitch deck sharing tool and found that the average number of slides in a pitch deck (where 100% of slides were viewed) was 12.2 slides.

General Recommendations

For investment presentations, the ideal length typically falls between 10 to 15 slides. This range is based on industry standards and feedback from investors, ensuring that you provide enough information without overwhelming your audience.

Alex Iskold of 2048 recommends a short pitch deck that should be 10 or fewer slides.

Related Resource: Pitch Deck 101: How Many Slides Should My Pitch Deck Have?

- Concise and Focused: Keep your presentation concise, focusing on the most critical aspects of your business. Each slide should deliver a clear and impactful message.

- Engagement: Investors have limited attention spans, and a concise presentation helps maintain their interest and engagement throughout.

- Title Slide: 1 slide

- Executive Summary: 1 slide

- Problem Statement: 1 slide

- Solution: 1 slide

- Market Opportunity: 1-2 slides

- Product or Service: 1 slide

- Business Model: 1 slide

- Go-to-Market Strategy: 1 slide

- Competitive Analysis: 1 slide

- Traction and Milestones: 1 slide

- Financial Projections: 1-2 slides

- Team: 1 slide

- Ask and Closing: 1 slide

What Your Pitch Deck Should Look Like for Your Investment Presentation

Every business is unique, and the specific needs for slides and narratives will vary. However, there are key elements that are essential for any successful investment presentation. Below are the crucial slides that should be included in your pitch deck, ensuring you effectively communicate your business potential to investors:

- Objective: Clearly present your company and its purpose.

- Content: Provide a brief and digestible summary of what your company does, including its mission, vision, and core values. Make sure it's easy for investors to understand.

- Objective: Define the problem you are solving.

- Content: Use data, stories, or compelling examples to illustrate the problem your target market faces. Help your audience grasp the significance and urgency of the problem.

- Objective: Explain how your product or service addresses the problem.

- Content: Detail your solution and make a strong case for why your approach is the best way to solve the problem. Highlight any unique features or innovations.

- Objective: Define your ideal customer and market.

- Content: Lay out the target market, including demographics and psychographics. Explain why this market is relevant and ready for your solution, helping investors answer the “why now?” question.

- Objective: Demonstrate the potential size and growth of the market.

- Content: Provide data on market size, growth trends, and potential for scalability. Investors want to see that there is a substantial opportunity for your business to grow and succeed.

- Objective: Identify your competitors and your differentiators.

- Content: Present an analysis of your competitors, detailing their strengths and weaknesses. Explain how your business stands out and what gives you a competitive edge.

- Objective: Highlight the status and future plans for your product.

- Content: Showcase your product with current status, features, and future development plans. Use data, customer testimonials, or case studies to demonstrate its value and effectiveness.

- Objective: Introduce the team that will execute the business plan.

- Content: Highlight key members of your executive team, emphasizing their relevant experience and skills. Show why your team is uniquely positioned to solve the problem and drive the company’s success.

- Objective: Explain how your business will generate revenue and grow.

- Content: Detail your business model, including revenue streams, pricing strategy, and scalability. Outline your sales and marketing strategy, including customer acquisition and retention plans.

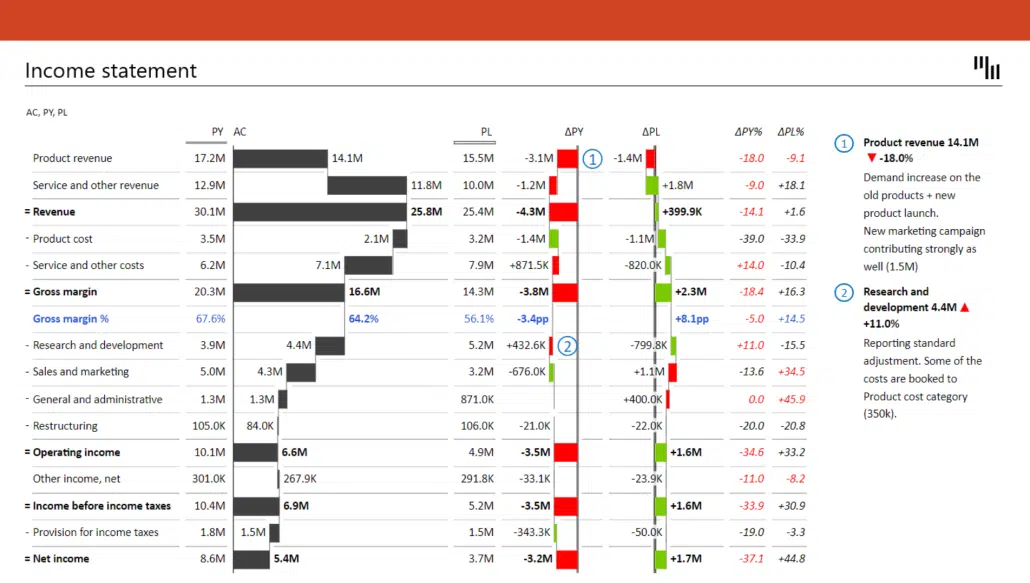

- Objective: Provide a clear picture of your business’s financial health and potential.

- Content: Present key financial data, such as revenue, expenses, profit margins, and growth projections. Include important metrics like customer acquisition cost, lifetime value, and burn rate. Clearly state your funding requirements and how the investment will be used.

Best Practices and Tips for Creating a Compelling Investment Presentation

As we’ve mentioned, different investors will look for different attributes in a presentation. However, most things investors look for can be boiled down to a few key areas. Below we lay out a few best practices for putting together a top-notch investor presentation.

Practice your pitch

This should go without saying but make sure you practice your pitch. You should know the ins and outs of your presentation and business. Of course, practicing in front of a mirror or friend can only go so far.

Some founders and investors recommend “ranking” your investors before approaching investors. E.g. Tier 1 investors are the best fit, Tier 3 are less of a fit for your business. If you rank your investors you’ll be able to spend some of your earliest pitches on “Tier 3” (or lower fit) investors to dial in your pitch and prepare for your pitches with better fit investors later on in your fundraise.

Related Resource: How to Pitch a Perfect Series B Round (With Deck Template)

Keep your message simple and clear

Investors see hundreds or thousands of pitches over a given year. Being able to clearly articulate your message and pitch is a surefire way to remove any confusion. By keeping your message simple and clear, you’ll remove any back-and-forth wasted on small details and be able to spend time on what matters most — having a conversation about your business.

Find ways to connect with the investors and know your audience

Understand who you are presenting to and tailor your content accordingly. Research the investors' backgrounds, interests, and previous investments to align your pitch with their preferences and expectations.

At the end of the day, a founder is selling their company to potential investors. Like a good sales process, a good investor pitch starts by building a relationship and trust. When pitching potential investors, find ways to connect with them in advance of the pitch. This could be everything from following and interacting with them on Twitter to going to in-person events where they are present.

Highlight early successes and wins

Get potential investors excited about your business by sharing early successes and wins. This will get the presentation off on the right foot and allow everyone to build excitement around your business. Of course, try to back up your early successes and wins with data when possible.

Know your metrics

Inevitably, investors will want to dig into the metrics and data behind your business. For most investors, this is used to evaluate your business and could be considered the best predictor of success for your business.

However, metrics can also be a barometer for how well you know your business. You don’t need to remember every data point behind your business but need to know how different metrics are calculated and what causes any major fluctuations.

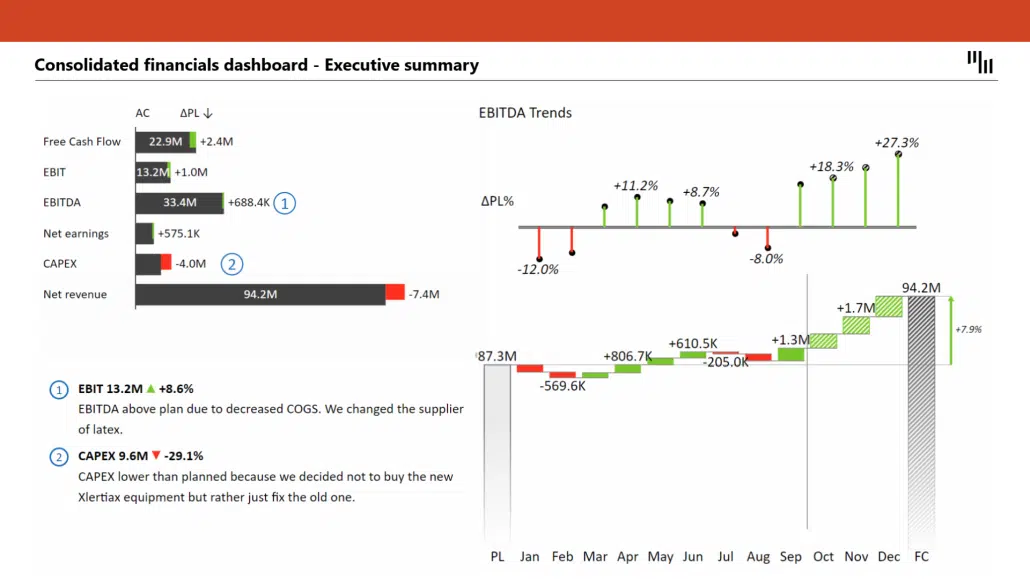

Include engaging visuals and graphics

Visuals can make your presentation more engaging and easier to understand. An investor presentation is a tool used to pitch your business. In order to best engage with your audience, you should aim to have engaging visuals and graphics throughout your presentation. Of course, the underlying data is what is most important but having engaging and easy-to-understand visuals and graphics is a great way to support and improve your pitch.

- High-Quality Images: Use professional images and graphics to illustrate points.

- Charts and Graphs: Simplify complex data with easy-to-read charts and graphs.

- Consistent Design: Maintain a consistent and professional design throughout the presentation.

Leave time for questions

The best pitches and presentations tend to be more conversational. You’ll want to balance feeding your investors with the material they need and also be able to have a constructive conversation about your business. By coming prepared, having a clear and simple presentation, and engaging with your investors beforehand is a surefire way to have a conversation about your business.

- Q&A Session: Allocate a portion of your presentation time for a Q&A session.

- Prepare Answers: Anticipate common questions and prepare thoughtful responses.

Communicate before your presentation

Investors need months of data and interactions to make a decision about a potential investment. In order to best help investors build conviction and have more meaningful conversations, make sure you are engaging with potential investors on a regular basis. This can be in the form of your monthly investor updates or sharing your pitch deck in advance before a meeting.

Sharing your pitch deck in advance of a meeting is a hot topic. Some investors will say you should and some will say the opposite. At the end of the day, it is important for you to feel out the investor and do what you believe is best for you and your business.

Related Resource: 18 Pitch Deck Examples for Any Startup

Qualities Investors Want to See

An investor’s primary goal is to generate returns for their investors (limited partners, LPs). While specific criteria can vary from firm to firm, there are common attributes that most investors look for in a founder and their business. Understanding these qualities can help you tailor your investment presentation to meet investor expectations.

Large Market

- Market Size and Potential: Investors seek businesses with the potential to capture significant market share in a large or rapidly growing market. Clearly articulate the size and growth prospects of your target market.

Clear Customer Acquisition Strategy

- Go-to-Market Plan: Demonstrate a well-defined strategy for acquiring and retaining customers. Investors want to see a scalable and cost-effective approach to growing your customer base.

Experienced Team

- Relevant Expertise: Highlight the experience and skills of your team members, particularly those relevant to your industry. An experienced team can significantly increase investor confidence.

- Track Record: Showcase past successes and relevant achievements of your team members.

Strong Leadership

- Visionary Leaders: Investors look for founders who are not only capable of executing the business plan but also possess a clear vision for the company’s future.

- Decision-Making: Demonstrate your ability to make strategic decisions and lead the company through challenges.

Traction and Growth

- Evidence of Progress: Provide concrete evidence of traction, such as user growth, revenue milestones, partnerships, or product development progress. Traction is a key indicator of potential success.

- Growth Metrics: Highlight key growth metrics and explain how you plan to sustain and accelerate growth.

- Long-Term Goals: Articulate a compelling long-term vision for your company. Investors want to invest in businesses that aim to create significant impact and value over time.

- Innovation: Emphasize any innovative aspects of your business that set you apart from competitors and position you for future success.

Coachability

- Willingness to Learn: Investors appreciate founders who are open to feedback and willing to adapt. Show that you value input from experienced advisors and are willing to make changes to improve the business.

- Collaborative Attitude: Demonstrate your ability to work collaboratively with investors and other stakeholders.

Related Resource: Startup Metrics You Need to Monitor

In-person vs. Remote Investment Presentations

The format of your investment presentation can significantly impact its effectiveness. With the rise of remote work, understanding the nuances of both in-person and remote investment presentations is crucial. Here’s a comparison to help you decide which format is best for your needs and how to optimize each type.

In-Person Presentation

Advantages:

- Personal Connection: In-person presentations allow for stronger personal connections. You can read body language, engage more naturally, and build rapport with potential investors.

- Undivided Attention: Investors are more likely to give you their full attention in a face-to-face meeting, reducing the risk of distractions.

- Interactive Demonstrations: Demonstrating your product or service is often more effective in person, where investors can experience it firsthand.

Disadvantages:

- Logistics and Costs: Traveling for in-person meetings can be time-consuming and costly, especially if you need to meet investors in different locations.

- Limited Reach: You may be limited to investors within a certain geographical area, potentially missing out on opportunities with investors elsewhere.

Tips for In-Person Presentations:

- Preparation: Ensure all materials are ready and that you have practiced your pitch thoroughly.

- Engage the Audience: Make eye contact, use hand gestures, and move around the room to keep investors engaged.

- Interactive Elements: Include live product demonstrations or prototypes to make your presentation more impactful.

Remote Presentation

- Wider Reach: Remote presentations allow you to connect with investors from all over the world without the need for travel.

- Cost-Effective: Eliminating travel reduces costs and time commitments, allowing you to schedule more meetings.

- Flexibility: Remote meetings can be more easily scheduled, offering flexibility for both you and the investors.

- Technical Challenges: Technical issues such as poor internet connection or software glitches can disrupt the flow of your presentation.

- Reduced Personal Connection: Building rapport and reading body language can be more challenging in a virtual setting.

Tips for Remote Presentations:

- Technical Preparation: Test your equipment and internet connection before the meeting. Ensure you have backups in case of technical issues.

- Engaging Visuals: Use high-quality visuals and animations to keep the audience engaged. Make your slides more visually appealing to compensate for the lack of physical presence.

- Interactive Tools: Utilize features like screen sharing, polls, and Q&A sessions to make the presentation interactive.

- Clear Communication: Speak clearly and at a moderate pace. Use gestures and facial expressions to convey enthusiasm and maintain engagement.

Key Elements of a Business Presentation for Investors

A business presentation is a structured communication tool used to convey information, ideas, or proposals to an audience. The purposes of a business presentation can vary, including:

- Informing: Providing important updates, data, or insights about your company or industry.

- Persuading: Convincing the audience to take a specific action, such as investing in your business.

- Educating: Teaching the audience about a new concept, product, or strategy.

- Engaging: Building relationships and fostering interaction with stakeholders.

For investors, the primary purpose of a business presentation is to persuade them of the viability and potential of your business as an investment opportunity.

How a Business Presentation Sets the Stage for Successful Investment Pitches

Understanding the foundational elements of a business presentation is crucial for creating a compelling investment pitch. A well-structured business presentation lays the groundwork for effectively communicating your business idea, strategy, and potential to investors, ensuring you capture their interest and secure the funding you need.

Introduction to Business Presentations

A business presentation is a structured communication tool used to convey important information, ideas, or proposals to an audience. The primary purposes of a business presentation can vary, but they generally include:

- Informing: Providing updates, data, or insights about your company or industry.

For investors, the main purpose of a business presentation is to persuade them of the viability and potential of your business as an investment opportunity.

Structure of a Business Presentation

A well-structured business presentation typically includes the following elements, which are equally essential in an investment pitch:

- Contents: Company name, logo, tagline, and presentation date.

- Purpose: To introduce the presentation and set the stage for what is to come.

- Contents: A brief overview of the main points of your presentation.

- Purpose: To provide a snapshot of your business, key metrics, and the investment opportunity.

- Contents: Description of your company, mission statement, and core values.

- Purpose: To introduce your business and its vision to the audience.

- Contents: A clear explanation of the problem your business aims to solve.

- Purpose: To highlight the need for your product or service.

- Contents: Description of your product or service and how it addresses the problem.

- Purpose: To demonstrate the value and effectiveness of your solution.

- Contents: Data on market size, growth potential, and trends.

- Purpose: To show the potential scale and impact of your business.

- Contents: Detailed information about your product or service, including features and benefits.

- Purpose: To showcase what you offer and why it stands out.

- Contents: Explanation of how your business makes money.

- Purpose: To illustrate the financial viability and scalability of your business.

- Contents: Plan for acquiring and retaining customers.

- Purpose: To show how you will reach your target market and grow your customer base.

- Contents: Overview of the competitive landscape and your unique advantages.

- Purpose: To highlight how your business differentiates itself from competitors.

- Contents: Key achievements and milestones reached to date.

- Purpose: To demonstrate progress and potential for future growth.

- Contents: Revenue forecasts, profit margins, and key financial metrics.

- Purpose: To provide a clear picture of your business’s financial future.

- Contents: Introductions to key team members and their qualifications.

- Purpose: To build confidence in the team’s ability to execute the business plan.

- Contents: Specific funding request and next steps.

- Purpose: To clearly communicate what you need from investors and how they can get involved.

Share your pitch deck with Visible

With our suite of fundraising tools, you can easily find investors , share your pitch deck, and track your fundraising funnel. Learn more about our pitch deck sharing tool and give it a free try here .

6 Powerful Tips for Crafting Outstanding Investor PowerPoint Presentations

In today's competitive business landscape, effectively communicating your company's potential to investors is crucial for securing funding and driving growth. Investor PowerPoint presentations play a significant role in conveying your vision, business model, financials, and growth prospects in a visually appealing and engaging manner. A well-prepared and compelling presentation can capture investors' attention and convince them to invest in your business.

This guide provides you with powerful tips and best practices for crafting outstanding investor PowerPoint presentations. By following these guidelines, you will be better equipped to create a presentation that clearly communicates your business's potential, showcases your achievements, and highlights the key information investors are looking for. This will ultimately increase your chances of securing investment and driving your business toward success.

Key Information Investors Look For

When creating investor PowerPoint presentations , it's essential to understand what information investors are typically looking for to make well-informed decisions. By focusing on these key aspects, you can ensure that your presentation effectively addresses investors' concerns and interests.

- Business Model and Market Opportunities: Investors need a clear understanding of your business model and market opportunities. This includes information about market saturation, market shares, and the overall size and growth potential of the industry. Additionally, they will want to know about your competitors, their strengths and weaknesses, and how you plan to differentiate your product or service. Any regulatory requirements or outstanding major lawsuits that could impact your business should also be addressed.

- Management Team and Key Employees: Investors want to meet the management team and recognize key employees. Including short CVs or bios in your PowerPoint presentations can help investors understand the team's capabilities, track record, and how they plan to lead the company to success.

- Financials and Key Metrics: Your investor PowerPoint presentations should include key financial data such as revenue, profit margins, working capital, debt position, and cash flow. Industry-specific key metrics, such as customer acquisition cost, lifetime value of a customer, and churn rate, should also be presented. These metrics help investors assess your company's financial performance and potential.

- Growth Prospects and Potential Returns: Investors want to see that your company has strong growth prospects and the potential to generate significant returns. Be sure to outline your growth plans and how you intend to achieve them in your investor PowerPoint presentations.

By incorporating these key aspects into your investor PowerPoint presentations, you can effectively address the information investors are most interested in and increase your chances of securing the funding you need.

Crafting a Compelling Story

A successful investor PowerPoint presentation tells a captivating story that highlights your business model, market opportunities, and investment benefits. By weaving together a compelling narrative, you can better engage your audience and provide a memorable context for the information you present. Here's how to craft a compelling story for your investor PowerPoint presentations:

- Start with a Strong Opening: Begin your presentation by clearly stating the problem your business is solving or the opportunity it is addressing. This sets the stage for your story and immediately captures your audience's attention.

- Showcase Your Business's Journey: Provide a brief overview of your company's history, including major milestones and achievements. This helps build credibility and demonstrates your team's ability to execute their vision.

- Highlight Your Unique Value Proposition: Clearly articulate what sets your product or service apart from the competition. Focus on the unique aspects of your business that give you a competitive advantage and support your success.

- Share Customer Success Stories: Including testimonials or case studies from satisfied customers can humanize your business and make your story more relatable. This also provides evidence of the value your product or service delivers to its users.

- Present Your Future Vision: Outline your company's goals and objectives for the future, and explain how you plan to achieve them. This demonstrates your ambition and commitment to growth, creating excitement and anticipation among investors.

- End with a Clear Call-to-Action: Conclude your investor PowerPoint presentation by summarizing the key points of your story and clearly stating what you want from investors. Be specific about the amount of funding you need and how it will be used to help your business achieve its goals.

By crafting a compelling story in your investor PowerPoint presentations, you can create an emotional connection with your audience and leave a lasting impression that can significantly impact their decision to invest in your business.

Want to skip all the fuss and create a professional PowerPoint side deck with only a few clicks?

Try Zebra BI for Office and supercharge your slide deck with powerful visuals.

Keeping It Focused and Simple

Investor PowerPoint presentations should be concise and easy to understand, allowing investors to quickly grasp the essential information about your business. By keeping your presentation focused and simple, you can ensure that your audience remains engaged and retains the key points you want to convey. Here are some tips for maintaining focus and simplicity in your investor PowerPoint presentations:

- Prioritize Key Points: Identify the most crucial aspects of your business that investors need to understand, and prioritize those points in your presentation. By concentrating on the most relevant information, you can avoid overwhelming your audience with excessive detail.

- Use clear and concise language: Present your ideas using straightforward, concise language. Avoid jargon and complex terms that confuse your audience. Remember, not all investors will have an in-depth knowledge of your industry, so it's essential to make your presentation accessible to everyone.

- Limit the Number of Slides: Aim for a concise presentation with a limited number of slides. A general rule of thumb is to have no more than 10-15 slides for a typical investor PowerPoint presentation. This helps you maintain a focused narrative and ensures you don't lose your audience's attention.

- Keep Visuals Uncluttered: Use clean, minimalistic visuals that clearly illustrate your points without distracting from the message. Avoid cluttered slides with too much text or too many images. Instead, opt for simple charts, graphs, and images that effectively convey your message.

- Highlight One Idea per Slide: To keep your presentation focused, present only one main idea per slide. This approach ensures that each concept is given adequate attention and makes it easier for your audience to follow along and digest the information.

- Rehearse and Refine: Practice delivering your investor PowerPoint presentation and refine it based on feedback from peers or advisors. This process helps you identify areas where you can simplify or clarify your message, ensuring that the final version is as focused and easy to understand as possible.

By keeping your investor PowerPoint presentations focused and simple, you can effectively communicate your business's key information and make a strong impression on your audience, increasing your chances of securing investment.

Utilizing Visuals Effectively

Visuals play a crucial role in making investor PowerPoint presentations more engaging and impactful. When used effectively, visuals can illustrate complex ideas, support your narrative, and emphasize key points. Here are some tips for utilizing visuals effectively in your investor PowerPoint presentations:

- Choose the Right Visuals: Select visuals that accurately represent the information you want to convey. Use charts and graphs for presenting data , diagrams for illustrating processes or relationships, and images or icons for emphasizing key concepts.

- Maintain consistency: Use a consistent visual style throughout your presentation to create a cohesive look and feel. This includes using similar colors, fonts, and graphical elements that align with your company's branding.

- Simplify Data Visualization: When presenting data, opt for clear and straightforward charts or graphs that are easy to read and understand. Avoid overly complicated visuals that confuse your audience or obscure the main message.

- Balance Text and Visuals: Strive for a balance between text and visuals on each slide. Too much text can be overwhelming and difficult to read, while too many visuals can be distracting. Aim to create a harmonious blend of both elements that effectively convey your message.

- Use High-Quality Images: Ensure that all images, icons, and graphics used in your investor PowerPoint presentations are of high quality and resolution. Blurry or pixelated visuals can appear unprofessional and detract from your message.

- Opt for Readable Fonts and Colors: Choose fonts and colors that are easy to read and provide sufficient contrast between text and background. Avoid using excessively small font sizes or color combinations that strain the eyes.

- Animate with a Purpose: If you use animations or transitions, use them sparingly and for a clear purpose. Excessive or overly flashy animations can distract and detract from your presentation's overall message.

By utilizing visuals effectively in your investor PowerPoint presentations, you can create a more engaging and memorable experience for your audience, ultimately increasing your chances of securing investment and driving your business forward.

Highlighting Key Metrics and Data

Presenting key metrics and data in your investor PowerPoint presentations helps demonstrate your company's financial performance , growth potential, and overall viability. By effectively showcasing this information, you can provide investors with a clear understanding of your business's strengths and the potential return on their investment. Here are some tips for highlighting key metrics and data in your investor PowerPoint presentations:

- Identify the Most Important Metrics: Determine the most relevant and impactful metrics for your business and industry. These may include financial figures such as revenue growth, profit margins, and cash flow. In addition, they may include industry-specific metrics like customer acquisition cost, lifetime value of a customer, and churn rate.

- Use appropriate data visualization: Present your metrics and data using clear, easy-to-understand charts and graphs. Choose the most suitable visualization method for each data set. This includes line charts for displaying trends over time, bar charts for comparing values across categories, or pie charts for showing proportions.

- Emphasize Key Data Points: Draw attention to the most relevant data points or metrics by using bold colors, larger font sizes, or other visual elements. This helps ensure that investors can quickly identify and understand crucial information in your presentation.

- Provide Context for Your Metrics: When presenting metrics and data, provide context to help investors understand their significance. This may include comparing your figures to industry benchmarks, discussing historical trends, or explaining the impact of specific events on your numbers.

- Include Projections and Forecasts: Investors are interested in your company's future growth potential, so include projections and forecasts in your investor PowerPoint presentations. Clearly outline your assumptions and methodologies, and demonstrate how your plans align with these projections.

- Be transparent and honest: Present your data and metrics accurately and transparently. Be prepared to explain any discrepancies or anomalies, and avoid manipulating figures to create misleading impressions. Transparency and honesty help build trust with investors and support your presentation's credibility.

By effectively highlighting key metrics and data in your investor PowerPoint presentations, you can give investors the information they need to evaluate your business' potential. Enabling them to make informed investment decisions, in turn, increase your chances of securing the funding necessary to grow and succeed.

Polishing and Practicing Your Presentation

A polished and well-rehearsed investor PowerPoint presentation demonstrates professionalism but also helps you deliver your message confidently and effectively. Taking the time to refine and practice your presentation can significantly impact investors' impressions. Here are some tips for polishing and practicing your investor PowerPoint presentation:

- Review and Edit Your Content: Carefully read through your presentation, checking for errors in grammar, spelling, and punctuation. Ensure that your content is clear, concise, and easy to understand. Consider asking a colleague or advisor to review your presentation and provide feedback.

- Ensure Consistent Design and Branding: Check that your presentation's design elements, such as colors, fonts, and graphics, are consistent throughout and align with your company's branding. Consistency creates a cohesive and professional look, reinforcing your company's identity.

- Optimize Slide Transitions and Animations: Make sure that any slide transitions or animations you include are smooth and serve a purpose, such as emphasizing a point or guiding the audience's attention. Avoid excessive or overly flashy transitions that can distract or detract from your message.

- Test on Different Devices: To ensure that your investor PowerPoint presentation displays correctly on various screens and devices, test it on different monitors, projectors, or laptops. This helps identify and resolve any formatting or compatibility issues before presenting to investors.

- Practice Your Delivery: Rehearse your presentation multiple times, focusing on your pacing, tone, and body language. Practicing helps you become more comfortable with the material and enables you to speak confidently and clearly.

- Anticipate Questions and Prepare Answers: Think about potential questions investors might ask and prepare thoughtful, data-backed responses. This demonstrates your expertise and preparedness, building trust and credibility with your audience.

- Adjust Based on Audience Feedback: After practicing your presentation, consider any feedback or reactions from your test audience. Be open to adjustments to improve your presentation's clarity, engagement, and effectiveness.

By polishing and practicing your investor PowerPoint presentation, you can ensure a professional, engaging, and impactful presentation that effectively communicates your business's potential and increases your chances of securing investment.

Creating an effective investor PowerPoint presentation is crucial for capturing potential investors' attention and securing the funding needed to grow your business. By focusing on the key elements discussed in this guide, you can craft a compelling and engaging presentation that showcases your company's potential:

- Craft a compelling story that highlights your business model, market opportunities, and investment benefits.

- Keep your presentation focused and simple, prioritizing key points and using clear, concise language.

- Utilize visuals effectively to enhance your message and engage your audience.

- Highlight key metrics and data that demonstrate your company's financial performance and growth potential.

- Polish and practice your presentation to ensure professional and confident delivery.

By following these tips and putting in the necessary effort to create a well-structured, engaging, and data-driven investor PowerPoint presentation, you can significantly increase your chances of securing the investment needed to propel your business forward.

Ready to supercharge your PowerPoint presentations?

Try Zebra BI for Office for free. Don't miss the chance to create engaging presentations that drive results for free!

Related posts:

- 7 Tips for Creating Effective Financial PowerPoint Presentation: Best Practices and Techniques

- How to Apply Design to All Slides in PowerPoint

- Best practices for creating PowerPoint template for business presentations

- How to Add Checkboxes in PowerPoint: A Comprehensive 5-Step Guide for Engaging Presentations

Leave a Comment Cancel reply

Want to join the discussion? Feel free to contribute!

Save my name, email, and website in this browser for the next time I comment.

Privacy Policy

Cookie Settings

Legal documentation

Try it in your Excel. For free.

- Investor relations

- LSE, AIM, & Aquis

Subscribe to get more articles like these in your inbox.

By submitting your email address and any other personal information to this website, you consent to such information being collected, held, used and disclosed in accordance with our privacy policy and our website terms and conditions.

How to Create an Effective Investor Presentation

Investor presentations are a crucial tool for entrepreneurs and business owners seeking funding or investment opportunities. A well-crafted presentation can captivate potential investors, showcase your business's potential, and ultimately secure the financial support you need. To help you create an effective investor presentation that stands out from the crowd, we've compiled some essential tips and strategies.

Understanding Your Audience

Before diving into the details of your presentation, it's crucial to understand your audience. Investors have specific expectations and interests, so tailoring your pitch to their needs is essential. Research the individuals or firms you will be presenting to, and consider their investment preferences, industry focus, and track record. By understanding your audience, you can customize your presentation to resonate with their specific interests and increase your chances of success.

Crafting a Compelling Story

Every great investor presentation tells a compelling story. Start by clearly articulating your business's mission, vision, and unique value proposition. Describe the problem your product or service solves and how it addresses a market need. Use storytelling techniques to engage your audience emotionally and make your presentation memorable. By connecting with investors on a deeper level, you increase the likelihood of their investment in your business.

Presenting a Solid Business Plan

A well-structured and comprehensive business plan is the backbone of any investor presentation. Start with an executive summary that provides a concise overview of your business, highlighting key aspects such as market opportunity, competitive advantage, and financial projections. Then, dive into the details of your business model, target market, marketing strategy, and sales projections. Be prepared to answer questions and provide supporting data to back up your claims.

Creating Visually Engaging Slides

Investor presentations often rely heavily on visual aids, such as slides, to convey information effectively. When creating your slides, keep them clean, concise, and visually appealing. Use high-quality images, charts, and graphs to support your key points and make complex information more digestible. Avoid overcrowding your slides with text and opt for bullet points or short phrases instead. Remember, your slides should complement your presentation, not overshadow it.

Demonstrating Market Potential

Investors are often interested in the market potential of your business. Clearly articulate the size of your target market, its growth rate, and any emerging trends that support your business's viability. Use market research and industry data to back up your claims and demonstrate a thorough understanding of your industry's dynamics. Present a compelling case for why your business is well-positioned to capture a significant share of the market.

Highlighting Your Team's Expertise

Investors not only invest in ideas or products but also in the people behind them. Showcase your team's expertise, experience, and track record to instill confidence in potential investors. Highlight key team members and their accomplishments, emphasizing how their skills align with the business's goals. Demonstrating a strong and capable team can significantly enhance your presentation and increase investors' trust in your ability to execute your business plan successfully.

Addressing Potential Risks

No business is without risks, and investors understand that. Acknowledge and address any potential risks or challenges your business may face. Be transparent about your mitigation strategies and contingency plans, showing investors that you have considered potential obstacles and have a plan in place to overcome them. This demonstrates your preparedness and commitment to ensuring the long-term success of your venture.

Crafting an effective investor presentation requires careful planning, research, and attention to detail. By understanding your audience, telling a compelling story, presenting a solid business plan, creating visually engaging slides, demonstrating market potential, highlighting your team's expertise, and addressing potential risks, you can create a presentation that stands out and captures the attention of potential investors. Remember, practice makes perfect, so rehearse your presentation thoroughly to deliver a confident and impactful pitch. Good luck!

Want more articles like this?

Sign up to our newsletter for bi-weekly insights and join the 4,000+ weekly readers at Airtasker, Liontown Resources, Westpac, and more.

Suggested articles.

Cookie Settings

We use cookies to improve user experience. Choose what cookie categories you allow us to use. You can read more about our Cookie Policy by clicking on Cookie Policy below.

These cookies enable strictly necessary cookies for security, language support and verification of identity. These cookies can’t be disabled.

These cookies collect data to remember choices users make to improve and give a better user experience. Disabling can cause some parts of the site to not work properly.

These cookies help us to understand how visitors interact with our website, help us measure and analyze traffic to improve our service.

These cookies help us to better deliver marketing content and customized ads.

- Case Studies

- Free Coaching Session

What to Include in Your Presentations to Win Over Investors

Last Updated:

February 21, 2024

Convincing investors to back your business venture is no easy feat. They want to ensure that they are investing their money in a business that is likely to be successful and by extension, profitable. The best way to get investors’ attention is to sit them down and present your ideas to them directly. However, to do this well, you must show them an investment-winning presentation. If you do not feel that you have the necessary skills to create a compelling presentation, consider hiring a presentation design agency to create one.

Top Tips on What to Include in Investor Presentations:

- Investor Presentation Overview: An investor presentation provides a concise overview of your business vision, products, services, market opportunity, financial information, and funding requirements.

- Capture Attention Immediately: Engage investors from the start by explaining an industry problem and how your venture addresses it. Use compelling storytelling to convey your passion and vision.

- Introduce Your Team: Highlight the individuals running the company. Showcase their relevant skills and experience, ensuring investors have confidence in the team behind the venture.

- Prioritise Good Design: Ensure the presentation slides are visually appealing and free from distractions. Consider outsourcing to professional presentation designers if needed.

- Highlight Your USP: Clearly convey your venture's unique selling point (USP) and differentiate your business from competitors. Use real-life terms to explain the quantifiable value of your venture.

- Marketing and Sales Strategy: Dedicate a slide to your marketing and sales approach. Answer key questions like the chosen marketing strategy, its appropriateness, target audience awareness, and the sales cycle.

- High-Level Financial Overview: Present high-level financial information using pie charts or graphs for clarity. Detailed financial records can be shared post-presentation upon investor interest.

- Practice and Preparation: Before presenting to investors, practice the presentation to refine it and prepare for potential questions.

In essence, a well-structured and engaging investor presentation can significantly increase the chances of securing investment. It's crucial to be clear, concise, and compelling, showcasing the value and potential of the venture.

What is an Investor Presentation?

An investor presentation allows you to talk to investors about your venture. During the presentation, you will give a clear but concise overview of your business vision, the products and services you plan to provide, market opportunity, a summary of high-level financial information and funding requirements.

How to Create an Investment-winning Presentation

You do not have much time to win over investors. As a result, your presentation should be short but compelling. There are a few steps you can take to create an investment-winning presentation:

Capture attention immediately

Investors will sit through many investor presentations. You must quickly capture their attention to ensure they do not lose interest within the first few minutes of your presentation. Compelling storytelling will keep investors hooked. Explain to them how you came up with the idea for your venture and show them why you are passionate about your vision. For example, some of the best investor presentations start by explaining an industry problem, and the remainder of the presentation describes how the speaker’s venture fixes said problem using compelling business PowerPoint templates .

Introduce yourself and your team

If investors are to put their hard-earned money into your venture, they will want to know more about the individuals running the company. Without a good team, there is no good investment. If your team is present at the presentation, they should briefly introduce themselves and explain their relevant skills and experience. If they are not present, make sure to include a slide that introduces them with a high-quality, professional photo and a short description of their relevant skills and experience.

Prioritise good design

Have you ever attended a presentation and found that you felt distracted by the atrocious design of the slides? Blurry images, inappropriate graphics, and huge blocks of text are incredibly off putting and will cause people to lose interest in a presentation. If you want to be creative and you're looking for engaging, simple-to-use PowerPoint business templates , check out SlidesCarnival, they have a wide selection of design themes available.If you or other members of your team do not have the necessary skills to create an investment-winning presentation, consider outsourcing the task to presentation designers.

Explain your venture’s unique selling point

One of the most important aspects of your investor presentation is explaining your unique selling point (USP). Your USP differentiates your business, allowing it to stand out from the crowd. You should make your venture’s USP crystal clear to the investors. A great way to convey your product or service’s value proposition is to explain how your venture will influence consumers in real-life terms. For example, does it allow consumers to save money? If so, how much money? Investors love to see the quantifiable value of a venture. If the figures are promising, they are more likely to invest in your idea.

Summarise your marketing and sales strategy

You should dedicate a slide to your marketing and sales strategy . Investors will want to know how you plan to reach your product or service’s target market. Investors can then use this information to determine how your venture differentiates from others in the same market. Explain the marketing strategies you plan to use and your financial expectations for these activities. It may be tempting to go into heavy detail on this slide, but try to keep it simple and concise. Your slide should answer the following questions:

- What marketing strategy will you use?

- Why is this strategy appropriate for your chosen business model?

- How will you make your target audience aware of your product or service?

- What will your sales cycle look like?

Give a high-level overview of financials

Interested investors want to assess the financial health of your venture before investing. However, you do not have much time to communicate this information during the presentation. You should include high-level financial information in your presentation. The best way to share financial information quickly and clearly is to present it in pie charts or graphs. Then, if investors like the look of your venture’s high-level financials, they will ask to see more detailed records after the presentation.

How to Win Over Investors

Winning over investors is a challenge. However, being equipped with a concise but informative presentation will increase the likelihood of success. Make sure to practice your presentation before you present it to investors to iron out any issues and prepare for the questions investors may ask.

People Also Like to Read...

How to Create Better Digital Presentations

What Services Does A Presentation Company Provide?

© 2016 - 2024 Robin Waite. All rights reserved.

IMAGES

COMMENTS

Jul 14, 2024 · A good story in your investor presentation can be a multi-tool. It can do many jobs at once. A powerful story can help bring to life a complex idea. A story can make it easy for an investor to understand what drives your business and a strong story will give the investor something they will remember and repeat to their colleagues.

Nov 16, 2021 · When you’re about to raise capital for your startup, having a great investor presentation can grab the attention of VCs and angel investors. Potential investors often look for information like the problem you’re trying to solve, the business model, the financials and how you plan to spend the money you’re raising.

Aug 7, 2024 · For investors, the main purpose of a business presentation is to persuade them of the viability and potential of your business as an investment opportunity. Structure of a Business Presentation. A well-structured business presentation typically includes the following elements, which are equally essential in an investment pitch: Title Slide:

May 23, 2023 · By effectively highlighting key metrics and data in your investor PowerPoint presentations, you can give investors the information they need to evaluate your business' potential. Enabling them to make informed investment decisions, in turn, increase your chances of securing the funding necessary to grow and succeed.

Nov 14, 2023 · A well-crafted presentation can captivate potential investors, showcase your business's potential, and ultimately secure the financial support you need. To help you create an effective investor presentation that stands out from the crowd, we've compiled some essential tips and strategies. Understanding Your Audience

Feb 21, 2024 · Detailed financial records can be shared post-presentation upon investor interest. Practice and Preparation: Before presenting to investors, practice the presentation to refine it and prepare for potential questions. In essence, a well-structured and engaging investor presentation can significantly increase the chances of securing investment.