Franchise Business Plan Template

Franchise business plan.

If you want to start a franchise business or expand your current one, you need a compelling business plan.

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their franchise businesses.

How to Create a Franchise Business Plan

Below are links to the key elements of a successful franchise business plan:

- Executive Summary – The Executive Summary provides an overview of your franchise business plan including an introduction to your company, a description of your products or services, and a summary of your financial projections.

- Company Overview – The Company Overview should include a comprehensive business description of your franchise including the company’s business model, history, and mission statement.

- Industry Analysis – In the Industry Analysis, you should provide an overview of the market and trends in the industry that your franchise operates in.

- Customer Analysis – The Customer Analysis section should include a description of your target market, their needs and preferences, and how your franchise will fulfill those needs.

- Competitive Analysis – The Competitive Analysis section will detail your direct and indirect competitors, highlighting their strengths and weaknesses, and identifying your competitive advantage.

- Marketing Plan – The Marketing Plan will include the various marketing strategies that you will implement to attract customers, the marketing channels you will use to reach your target audience, and the projected budget for your marketing efforts.

- Operations Plan – In the Operations Plan, you will detail the day-to-day business operations including inventory management, staffing, and customer service procedures.

- Management Team – The Management Team section should introduce key team members and their roles in the franchise, highlighting their relevant experience and qualifications.

- Financial Plan – In the Financial Plan, you will include the financial details about your franchise business including franchise fees, start-up costs, revenue projections, and financial statements including an income statement, balance sheet, and cash flow statement.

- Appendix – The Appendix section will include supplemental documents that are referenced in your business plan including the franchise agreement, franchise disclosure document, complete financial projections, and any other supporting materials.

Next Section: Executive Summary >

Franchise Business Plan FAQs

What is the easiest way to complete my franchise business plan, where can i download a franchise business plan pdf, what is a franchise business plan, why do you need a business plan for a franchise.

If you’re looking to start a franchise or grow your existing franchise you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your franchise in order to improve your chances of success. Your franchise business plan is a living document that should be updated annually as your business grows and changes.

What Are the Sources of Funding for a Franchise?

What additional resources are available for prospective franchisees.

- How To Start a Franchise

- Top Franchise Opportunities

- A Consumer’s Guide To Buying a Franchise

- Franchise Marketing Strategies

FRANCHISE BUSINESS PLAN OUTLINE

- Franchise Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Franchise Business Plan Summary

Start Your Franchise Plan Here

Other Helpful Business Plan Articles & Templates

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How to Write a Business Plan for Your Franchise This vital step can make the difference between success or failure in the franchise world.

By Clarissa Buch Zilberman Edited by Carl Stoffers May 8, 2023

Opinions expressed by Entrepreneur contributors are their own.

You're set on becoming a franchisee . You may think it's time to call a franchisor, tell them you're interested, and get funding from your local bank , right? Wrong.

If you're considering buying a franchise, you'll need to write a thorough business plan before moving forward.

A business plan is a detailed document that describes how your business will achieve its goals. Consider it an essential tool for any business owner — including franchisees!

Sound daunting? It can be. But it's a crucial and necessary step in starting your own business. Plus, becoming a franchisee means that the franchisor will provide some of the strategies, plans and overall business information , with some minor tweaks for your specific market.

Here's how to get started.

Related: Considering franchise ownership? Get started now and take this quiz to find your personalized list of franchises that match your lifestyle, interests and budget.

Start with comprehensive research

Before you can begin writing your franchise business plan, you need to gather information about your franchise business . Research the industry, market trends and competitors in the area. You should utilize a SWOT (strengths, weaknesses, opportunities, and threats) analysis of the business, as well.

Next, research the franchisor's history, vision, mission and values . This will help you understand the franchisor's expectations and see if your goals align with the brand. You may have already done a lot of this research when narrowing down your franchise choices .

Related: The 4 Biggest Myths About Franchising

Define your business concept and target market

Your business concept should include details about your product or service , pricing strategy, location, unique selling proposition and market advantages.

Much of this information will be supplied by your franchisor. However, make sure to tweak it correctly for your specific location and audience .

Develop a financial plan

A financial outline is a critical component of your franchise business plan. It should include details about your startup costs, ongoing expenses , revenue projections and profitability.

You should also share cash flow, balance sheets and income statements here. With these documents, you can readily identify any gaps in your business and develop strategies to address them.

Related: 10 Tips to Go From Employee to Boss, From Franchisees Who Did It

Outline your marketing and sales strategy

You may get a headstart from your franchisor on the marketing and sales strategy . This is where you'll want to include more information about your target audience, marketing channels and tactics to promote your business.

From a sales strategy perspective , include your pricing strategy, sales team structure and sales targets that are tailored to your area.

Develop an operations plan

Your operations plan should include details about your day-to-day work, staffing requirements and supplier relationships. You should also outline any technology and equipment needs, inventory management and quality control procedures , some of which your franchisor may dictate.

Create a management team and personnel plan

Your management team and personnel plan should detail the leadership structure of your business, each team member's role and responsibility and the qualifications and experience needed for each position.

You should also outline a staffing plan , which will include your recruitment strategy, employee benefits and training and development programs.

Create an executive summary

An executive summary is literally a summary of your business plan that will provide all the necessary information to someone who only has a few moments to review your business plan. It should summarize the key points of your franchise business plan and research.

Get started by outlining your business plan

A franchise business plan, at the minimum, should include the following sections :

- Executive Summary: This section provides a brief overview of your business, your mission statement, goals and target market.

- Company Description: This section includes more information about your business, such as what you do or sell, your company history and your management team.

- Market Analysis: This section analyzes the market for your products or services, including your target market, competition and competitive advantage.

- Operations Plan: This section describes how your business will operate, including your location, your marketing and sales strategies and management and staffing plan.

- Financial Plan: This section projects your business's financial performance, meaning your revenue, expenses and profit.

- Appendix: This section includes supporting documents, such as financial statements, marketing materials and legal documents.

A business plan will help you succeed

Writing a franchise business plan is a critical step in becoming a successful franchisee . It requires comprehensive research, a well-defined business concept, a solid financial plan, a strong marketing and sales strategy, a detailed operations plan and a competent management team.

Remember: It's a living document, so be sure to update it regularly as your business grows and changes. This will ensure that your plan always reflects the current state of your business.

Tackle a business plan logically and seek help from an expert or your franchisor, as necessary. Then you're off to get your loan, finish your applications and open your doors !

Related: Is Franchising Right For You? Ask Yourself These 9 Questions to Find Out.

Freelance Writer, Editor & Content Marketing Consultant

Clarissa Buch Zilberman is a writer and editor based in Miami. Specializing in lifestyle, business, and travel, her work has appeared in Food & Wine, Realtor.com, Travel + Leisure, and Bon Appétit, among other print and digital titles. Through her content marketing consultancy, By Clarissa , she leverages her extensive editorial background and unique industry insights to support enterprise organizations and global creative agencies with their B2B, B2C, and B2E content initiatives.

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock I Started a Business to Streamline the $90 Trillion Wealth Transfer From Boomers to Younger Generations — Here's How It Helps People Receive Inheritances Faster

- Is ChatGPT Search Better Than Google? I Tried the New Search Engine to Find Out.

- This Couple Wanted to Make an Everyday Household Product 'Unquestionably Better.' Now Their Business Sees Over $200 Million Annual Revenue : 'Obliterated Our Goals.'

- Lock AI Could Ruin Your Life or Business — Unless You Take These Critical Steps

- Taco Bell Is Launching Chicken Nuggets — Here's When and Where to Get Yours

- Lock After This 26-Year-Old Got Hooked on ChatGPT, He Built a 'Simple' Side Hustle Around the Bot That Brings In $4,000 a Month

Most Popular Red Arrow

This ai is the key to unlocking explosive sales growth in 2025.

Tired of the hustle? Discover a free, hidden AI from Google that helped me double sales and triple leads in a month. Learn how this tool can analyze campaigns and uncover insights most marketers miss.

'We're Not Allowed to Own Bitcoin': Crypto Price Drops After U.S. Federal Reserve Head Makes Surprising Statement

Fed Chair Jerome Powell's comments on Bitcoin and rate cuts have rattled cryptocurrency investors.

A New Hampshire City Was Named the Hottest Housing Market in the U.S. This Year. Here's the Top 10 for 2024.

Zillow released its annual lists featuring the top housing markets, small towns, coastal cities, and geographic regions. Here's a look at the top real estate markets and towns in 2024.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Is Your Business Healthy? Why Every Entrepreneur Needs To Do These 3 Checkups Every Year

You can't plan for the new year until you complete these checkups.

Expand Your Global Reach with Access to More Than 150 Languages for Life

Unlock global markets with this language-learning platform.

Successfully copied link

- Accounting & Financial Franchises

- Advertising & Marketing Franchises

- Automotive Franchises

- Business Opportunities

- Business Services Franchises

- Children's Franchises

- Cleaning Franchises

- Coffee Franchises

- Computer & Internet

- Consultant & Business Brokers

- Courier Franchises

- Employment & Staffing

- Entertainment Franchises

- Fitness Franchises

- Food Franchises

- Health & Beauty

- Healthcare & Senior Care

- Home Based Franchises

- Home Services Franchises

- Industrial Franchises

- Mailing & Shipping

- Moving & Storage

- Pet Franchises

- Photography Franchises

- Printer, Copying & Sign Franchises

- Real Estate Franchises

- Restaurant Franchises

- Retail Franchises

- Sports Franchises

- Tax Franchises

- Training Franchises

- Travel Franchises

- Vending & ATM Franchises

- Franchises Under $10,000

- Franchises Under $20,000

- Franchises Under $30,000

- Franchises Under $40,000

- Franchises Under $50,000

- Franchises Under $60,000

- Franchises Under $70,000

- Franchises Under $80,000

- Franchises Under $90,000

- Franchises Under $100,000

- Franchises Under $200,000

- Franchises Under $300,000

- Franchises Under $400,000

- Franchises Under $500,000

- United States of America

- International Franchises

- Franchise Directory A-Z

- Top Franchises

- Hot & Trending Franchises

- New Franchises

- Low Cost Franchises

- Recession Resilient Franchises

- Green Franchises

- Mobile Franchises

- SBA Approved Franchises

- Special Financing Offers

- Franchises for Veterans

- Master Franchises

- Franchise Information Center

- Ultimate Guide to Franchising

- Ultimate Guide to Financing a Franchise

- Ultimate Guide to FDDs

- FDD Research Hub

- Franchise Services

- Franchise Direct Blog

- Franchise Articles

- Franchise Reports

- Franchise News

- Franchise Success Stories

- Testimonials

- Franchise Expos and Events

- Franchise Videos

- Discovery Days

- The Franchise Direct Top 100 Global Franchises List

- Franchise Direct's Top 100 Franchises 2024

- Franchise Direct's Top 100 Franchises 2023

- Top 100 Franchises Ranking for 2022

- Top 100 Franchises Ranking for 2021

- Franchise Direct's Top 100 Franchises 2020

- Client Sign in

Start Your Search For A Franchise...

Creating a business plan for your franchise: what to prepare before asking for money.

🕒 Estimated Reading Time: ~8 minutes

Congratulations! You’ve decided that owning a franchise is the right investment for you. You may have even already decided on the type of franchise, and maybe even the franchise brand you are going to pursue.

What’s next? Financing. Securing the funding needed to make your franchise dreams a reality. And unless you are one of the fortunate people that has enough money saved to cover costs, you will likely be seeking a lender to make up the difference between the amount of money you currently have to invest and amount of money needed to open and maintain your franchised business until you 'break even.' (Breaking even is the point in the lifespan of a business where the operation starts turning a profit.)

To convince lenders that you are worthy of their money, the creation of a business plan is crucial. Lenders use a business plan as a guide to assess whether the prospective franchisee is a on a path towards success and profitability.

To approve loans, lenders want to have a clear, straightforward account of the business to be opened, the principals involved, and—perhaps most importantly—perspective on when the borrowed money will likely be repaid.

It's helpful to prepare for the meeting with the lender like a college graduate student would prepare for a thesis defense presentation. In both instances, it is the goal of the person (or people) going into the meeting to have done the adequate level of research necessary to competently back up the stated claims for the desired result (be it the granting of a master's degree to the student or the gaining of a loan for the prospective franchisee).

Important note: the business plan isn’t just for getting money.

Not only does a business plan help in securing funding, it forces you to take a hard look at the investment you are about to make. It gives you a chance to anticipate the challenges that come with opening a business, and temper unrealistic expectations.

As time passes and you move further into franchise ownership, the business plan you’ve created should be updated and utilized as a guide in helping you reach your franchise goals.

Parts of a Business Plan

Creating a business plan doesn't have to be complicated.

There is no standardized length for a business plan, but no lender wants to read a novel-length presentation. The main thing is that the plan is thorough enough to cover all aspects of your individual franchise. You want to give the lender confidence that you are prepared to take on the managing of a business that will turn a profit in a reasonable amount of time.

The key is compiling the proper information to address the reservations of the lenders you will meet with. This is where opening a franchised business offers a notable advantage over an independent business.

The franchise disclosure document (FDD) provided by the franchisor of the system you are investing in contains a great deal of the information needed to complete a business plan.

This information includes the company’s corporate background, a description of the target market, the competitive advantage of the product/service, marketing initiatives, plus the start-up and ongoing costs. Some franchisors even offer assistance to franchisees in the preparation of the plan.

Common parts of a business plan include the following, according to the Small Business Administration (a sample business plan is located at the end of this article):

Company description: A good place to look for the information for this section is Item 1 of the FDD. Provide an overview of the franchise and its history to the lender. You will also provide a brief outline of the franchise’s service/product (more detailed information will be given in the next section).

Service/product description: Describe in detail the service and/or product your franchise will provide to customers. This section can be combined with the company description. Again, Item 1 of the FDD is where you will find much of the information you need for this section. Item 16 will also be helpful in discussing what you will and will not be able to sell as a franchisee of a particular franchise system.

Market analysis: Use this section to prove to the potential lender that you are not jumping into a business venture on a whim. Concentrate on the specific area (market) in which the franchised business will be located. The territory description in the FDD (Item 12) will help you to a point.

Give a brief discussion of the following:

- How big is your market?

- What kind of people (demographically and financially) make up this market?

- Is the market under-served in regards to this service/product?

- If there is competition, who are your competitors and what is your competitive advantage?

- Discuss what experts are forecasting for the service/product in terms of trends and growth possibilities for your specific market (can include demographic, legislative or environmental factors).

Management structure: This section provides a look at the people who will be responsible for the day-to-day operation of the franchise, particularly you as the owner. Is this venture going to be a sole proprietorship or will there be multiple owners? Explain if you will be involved day-to-day with business operations, or will be acting as an absentee owner.

For yourself and all of the others with an ownership stake, if applicable, detail all business qualifications. Stress any and all experience (even if volunteer) that is relevant to being successful in the future with the franchise operation. Item 15 of the FDD will help with explaining the managerial obligations of the franchisee.

Marketing plan: 'How are you going to get customers?' is the main question you’re answering in this section. Use FDD Item 11 to your advantage here. It provides an overview of the franchisor’s advertising and marketing efforts. Also, it provides a description of the training you will complete before opening. Often marketing and sales courses are part of required training.

Financials: This is the meat of your business plan. In this section, don’t only ask for the money you need. Give the lender the big picture of your financial situation as well. Detail how you are going to obtain the entire initial investment. Often times, a lender will not be financing all of the franchise investment. Are you using a mix of personal savings, loans, credit, etc.?

In addition to the funding request, you will be doing some financial projection. Give a reasonable time frame when the lender can expect full repayment of the loan, and back up that claim with figures. Include graphs and charts detailing the start-up costs, projected profit and loss and projected sales forecast for the franchise.

The franchisor can be of significant help to you in completing this section (via Items 5 and 19 of the FDD, and in direct conversation). However, keep in mind the franchisor is restricted legally about making certain claims about projected earnings. Be conservative with the projections as unexpected delays and unforeseen circumstances do happen.

Appendix: The appendix technically isn’t a part of the business plan, but an additional section to present items that would enhance your presentation. Include items you feel would be necessary to giving the lender a complete picture of you and the franchise you are seeking financing for. Examples include: the resumes of management figures, tax returns, media clippings, etc.

As previously mentioned, the best outside source of information to complete your business plan is the franchisor. No other outlet is going to know that franchise system better.

Additional resources include online sites such as Bplans.com, which offers site visitors a substantial library of sample plans to review, as well as general business websites like the Small Business Administration. Prospective franchisees can also use a professional business plan writer, particularly for the review of a plan before sitting down with the lender.

Confidentiality agreement: Because business plans contain sensitive and confidential information, the content needs to be safeguarded against potential leaks. To do this, you will need to enter into a confidentiality agreement with the parties you allow to review your business plan.

The agreement will bind them not to disclose or reveal any confidential information they receive, without your written permission.

Sample Business Plan Confidentiality Agreement Template

Sample franchise business plan: Please note that the example business plan linked below is a sample of one way to format a business plan. There are several different acceptable formats, and the contents of business plan sections will vary significantly due to factors including the franchise system, the type and amount of loan sought, the franchisee’s background, etc.

Sample Business Plan

Suggested reading:

- The Ultimate Guide to Franchising

- What is Franchising?

- The Benefits of Franchising

- Choosing the Most Profitable Franchise for You

- 11 Key Steps in Opening a Franchise

- Franchises vs. Business Opportunities

- The Cost to Start a Franchise and Financing Options

- Basics of the Franchise Disclosure Document (FDD)

- Creating a Business Plan for Your Franchise

- Completing and Signing a Franchise Agreement

You have saved info requests

Franchise Business Plan

Written by Dave Lavinsky

Franchise Business Plan Template

This sample franchise business plan, created by PlanBuildr.com, blends industry knowledge with practical insights. Whether you’re new to the world of franchising or you’re a seasoned business owner, this plan will serve as a crucial tool in making your franchise thrive

How To Write a Franchise Business Plan & Sample

Below is an example for each of the key elements of franchise business plan that you can use to create your own well-crafted business plan:

Executive Summary

Business overview.

Helping Heroes Home Care Franchise is a national franchise that is headquartered in Gilbert, Arizona. It is a home health care business started by Alma Briggs, Registered Nurse, after she noticed the lack of quality health care solutions for the aging population of the Phoenix area. Her business grew rapidly and she expanded her staff and eventually added locations throughout the Southwest United States. Today, Helping Heroes Home Care Franchise has 30 locations throughout the country with more franchisees submitting interest almost daily.

Helping Heroes Home Care Franchise offers home care services to adults who require health care needs in the comfort of their home upon being released from the hospital, rehabilitation facility, or nursing home. Helping Heroes Home Care provides skilled nursing services, therapy and rehabilitation, home health aide, and medical social workers.

Erica Moore is a Registered Nurse in Albuquerque, New Mexico and is opening the Helping Heroes Home Care Franchise Albuquerque location. Upon franchise approval and submitting her initial franchise investment, Erica will be employing a nurse, occupational therapist, nurse aid, and social worker for the first year of operations. As the Albuquerque location grows, more staff will be added as required.

Service Offering

The following are the services that Helping Heroes Home Care Franchise will provide:

- Skilled nursing services

- Therapy and rehabilitation by Occupational Therapists

- Home Health Aides

- Medical social work

Customer Focus

Helping Heroes Home Care Franchise will target those residents of Albuquerque, New Mexico that require nursing services and medical care at home. They are newly released from the hospital or a rehabilitation facility. Helping Heroes Home Care Franchise provides these services primarily to adults.

Management Team

Helping Heroes Home Care Franchise (Albuquerque) will be solely owned and operated by Erica Moore, a Registered Nurse in the state of New Mexico. Erica has worked as a home health care nurse in Albuquerque for five years. She saw the lack of quality care and reliable service and decided to leave the home care industry and save up to own her own health care business one day. For eight years, Erica worked for a rehabilitation facility all while saving up and researching reliable and quality home health care franchisors. Erica decided on Helping Heroes Home Care Franchise as they have a strong brand presence, strong marketing program, reliable technological support and training, implements the best clinical standards, and offers a scalable business model so that Erica can add multiple streams of revenue and grow her business year after year.

Success Factors

Helping Heroes Home Care Franchise will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly qualified team of nurses, occupational therapists, and social workers who are able to provide the highest standard of care in the comfort of a patient’s home.

- Customized plans that are affordable and flexible.

- A reputable franchise that offers the most support in order to provide the best clinical care per the franchise standards.

- Scalable business model to ensure each franchisee will successfully establish their business and grow to become more profitable each year.

- Technology and support by the franchise to receive ongoing operational support, business consultations, and training.

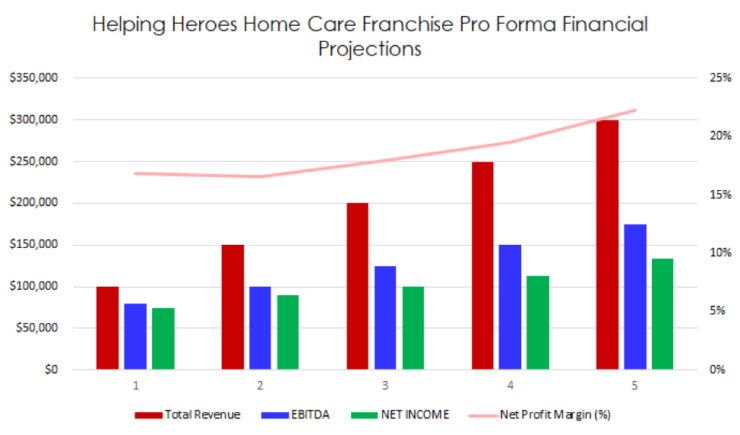

Financial Highlights

Helping Heroes Home Care Franchise (Albuquerque) is seeking $250,000 in debt financing to open the Albuquerque location. The funding will be dedicated towards securing the office space, office equipment, and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and franchise investment. The franchise investment is $150,000 to get approved and started. The fees paid to the franchise are then paid monthly as a percentage of revenue earned by the franchisee. The breakout of the funding is below:

- Securing office space and any build-out required: $50,000

- Franchise investment: $150,000

- Three months of overhead expenses (payroll, rent, utilities): $50,000

Company Overview

Who is helping heroes home care franchise.

Helping Heroes Home Care is a national franchise that provides home health services to seniors, those released from a rehabilitation facility or hospital, and those that require acute health care needs that require medical care at home. Helping Heroes Home Care provides skilled nursing services, therapy and rehabilitation, home health aide, and medical social workers. We work with the clients to continue their medical treatment at home. We learn about their situation and symptoms, develop a medical plan, and implement the best care plan available to prevent the client from needing to be admitted to the hospital again, and to promote self awareness and independence while working with the client in their home.

Erica Moore is a Registered Nurse at a rehabilitation hospital in Albuquerque, New Mexico. She has been working with patients that have been released from the hospital for over ten years. Previously, Erica was a home health nurse for a local home health care agency and treated hundreds of patients in their home. She saw firsthand the lack of resources and quality care available to the residents of Albuquerque and had a goal in mind of owning and operating her own home health care business. After spending the last ten years researching and developing a plan, Erica has decided that the best option is to become a franchisee for Helping Heroes Home Care Franchise. Helping Heroes Home Care Franchise offers the best quality care and support to its franchisees. Their comprehensive marketing plan, strong clinical standards, and technology and support will make a strong impact to those requiring home health care in Albuquerque.

Helping Heroes Home Care Franchise History

Helping Heroes Home Care Franchise was started by Registered Nurse Alma Briggs in 2006 in Phoenix, Arizona. Like Erica, she saw the lack of quality home health care available to her patients and wanted to make a difference. She and her husband saved money and eventually began Helping Heroes with one location in Glendale, Arizona. Her business grew steadily and she eventually added more nurses to support her, an office to be the center of operations, and grew into more locations throughout the Southwest. Today, Helping Heroes has grown to over 30 locations throughout the United States with more franchisees applying daily.

Since incorporation, Helping Heroes Home Care Franchise (Albuquerque) has achieved the following milestones:

- Found a small office space to be the physical location of the business

- Obtained legal licensing obligations, permits, and tax registrations.

- Applied to be a franchisee of Helping Heroes Home Care Franchise. Approval is pending capital requirements.

Helping Heroes Home Health Care Franchise Services

The following will be the services Helping Heroes Home Care Franchise will provide:

Industry Analysis

The Home Care Franchises industry will grow, as demand for services grows. The number of people 65 years or older in the United States is expected to increase at an annualized rate of 2.9% to 63.4 million people during the five-year period. This population demographic is the largest consumer of healthcare in the United States and will continue to demand a growing number of in-home care services as the trend toward aging in place strengthens. With the continued implementation of the Patient Protection and Affordable Care Act (PPACA), demand for industry services will accelerate as seniors and the disabled are transitioned from nursing home services to at-home managed care. Consequently, industry revenue is expected to increase at an annualized rate of 6.4% to nearly $15.0 billion.

Customer Analysis

Demographic profile of target market.

The precise demographics for Albuquerque, New Mexico are:

Customer Segmentation

Helping Heroes Home Care Franchise will primarily target the following customer profiles:

- Adult residents of Albuquerque, New Mexico requiring home health care

- Adults and/or seniors who have been released from the hospital or nursing home and either request or referred by a doctor to have home health care

- Adults and/or seniors who have been released from a rehabilitation facility who either request or are referred by a doctor to have home health care

Competitive Analysis

Direct and indirect competitors.

Helping Heroes Home Care Franchise will face competition from other companies with similar business profiles. A description of each competitor company is below.

TLC Home Healthcare Services

TLC Home Healthcare Services has been in business for over seven years. They provide services Monday through Friday and are available for on-call services after hours and on weekends. Their on-call services are to assist and triage any questions or concerns to the clients or family members for any issues they may be experiencing. Upon referral, they admit the patient into the system within 24 hours. There are physical therapy services on standby for evaluations needed during weekend admissions. Their focus is to immediately establish and initiate full recovery at home following an individualized plan of care soon after discharge from the hospital to maximize the rehabilitation potential by minimizing the time-lapsed between facility discharge and home healthcare evaluation. The mission of TLC is to provide professional and paraprofessional services to patients in their homes and assist them to achieve the highest level of potential in their day-to-day and self-care activities.

Interim Healthcare

Interim Healthcare has a fully trained staff of caregivers who are supervised by a registered nurse to provide the care needed in a patient’s home. They provide supervision, companionship, housekeeping, meal preparation, mobility support, transportation, medication reminders, grooming, and laundry. They provide as little or as much as needed. Interim provides respite care to offer relief for the primary family caregiver to take a break or get errands done. If it is no longer safe for the senior to be alone, the team at Interim Healthcare develops a plan for high-quality caregivers to provide home care around the clock. Interim Healthcare also offers hospice care by providing all basic needs are being met to ensure safety and basic needs are being met so that the families can focus on spending quality time together. Interim Healthcare charges by the hour with no minimum commitment or contracts. Their rates and plans are entirely flexible.

Compassus provides their clients with safe and reliable home care from a professional and trained staff. Their care is not one size fits all. They are committed to understanding the needs and offer personalized support. They provide home health care to seven counties throughout the Albuquerque area. Compassus’ team includes nurses, physical therapists, speech therapists, occupational therapists, home health aides, and social workers. They also offer expert care in the areas of total joint program, cardiac program, prehab program, and CHF program. Their patients are those who are discharged from a hospital or nursing home but need additional support at home, require short-term skilled assistance at home due to outpatient surgery, need additional skilled assistance to live independently due to illness, disability or aging, and require regular health care due to heart disease, diabetes, or other conditions like muscular, nervous, or respiratory disorders.

Competitive Advantage

Helping Heroes Home Care Franchise will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Helping Heroes Home Care Franchise will offer the unique value proposition to its clientele:

Promotions Strategy

The promotions strategy for Helping Heroes Home Care Franchise is as follows:

Helping Heroes Home Care Franchise is an already-established franchise that has a strong reputation in the healthcare community with their strong brand awareness. Hospitals, rehabilitation facilities, nursing homes, and doctors who specialize in seniors will recommend Helping Heroes to the families and patients needing home care services.

Franchise Marketing

Helping Heroes Home Care Franchise has a strong built-in marketing program that it provides to all of its franchisees. Upon acceptance as a franchisee, they are given a website page that feeds from their national page, social media accounts, flyers, and business cards for the franchisee to hand out to its contacts.

Website/SEO Marketing

Helping Heroes Home Care Franchise maintains a strong online presence. All franchisees have the unique advantage over their competition as Helping Heroes manages the website activity and pays to have a strong SEO presence so that when someone enters “home health care” in whichever city they are in, Helping Heroes Home Care is at the top of the list.

The pricing of Helping Heroes Home Care Franchise will be moderate and on par with competitors, so customers feel they receive value when purchasing their services.

Operations Plan

The following will be the operations plan for Helping Heroes Home Care Franchise (Albuquerque).

Operation Functions:

- Erica Moore will be the owner and operator of Helping Heroes Home Care in Albuquerque. She will employ and lead a team of nurses, occupational therapists, and social workers to carry out and establish the presence of Helping Heroes in Albuquerque.

- Erica will employ an office administrator to answer phone calls and assist with scheduling the staff to see their patients.

- Erica will start with one nurse, one occupational therapist, one nurse aid, and one social worker to join her team for the first year of operations. As the franchise presence grows into a steady stream of business, Erica will add more nurses, therapists, and social workers to meet the demands of the home care franchise.

Milestones:

Helping Heroes Home Care Franchise will have the following milestones complete in the next six months.

5/1/202X – Finalize contract to lease small office space

5/15/202X – Obtain small business loan to meet the capital requirements of being a Helping Heroes Home Care Franchisee

6/1/202X – Begin training program for Helping Heroes

6/15/202X – Start hiring staff and have them begin the Helping Heroes Home Care employee standards

8/1/202X – Begin first set of home visits referred by clients and/or those referred Helping Heroes national franchise

Helping Heroes Home Care Franchise (Albuquerque) will be solely owned and operated by Erica Moore, RN.

Erica Moore is a Registered Nurse in the state of New Mexico. She received her Bachelor’s of Nursing degree from the University of New Mexico in 2008. Upon licensure and graduation, Erica has worked as a home health care nurse in Albuquerque for five years. She saw the lack of quality care and reliable service and decided to leave the home care industry and save up to own her own health care business one day. For eight years, Erica has worked for a rehabilitation facility all while saving up and researching reliable and quality home health care franchisors. Erica decided on Helping Heroes Home Care Franchise as they have a strong brand presence, strong marketing program, reliable technological support and training, implements the best clinical standards, and offers a scalable business model so that Erica can add multiple streams of revenue and grow her business year after year.

Financial Plan

Key revenue & costs.

The revenue drivers for Helping Heroes Home Care Franchise are the fees it will charge to the patients for the home care services it will provide. The fees are paid for all or in part by the insurance company of the patient. The remaining balance will be paid by the patient or the family.

The cost drivers will be the fees paid to the franchise, payroll for the employees (office administrator, nurse, occupational therapist, and social worker), rent and utilities for the office space, and office supplies. The marketing, training, and technology costs are part of the franchise fees paid to the Helping Heroes Home Care Franchise.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Initial Patients per Month: 40

- Average Fees per Month: $50,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, free franchise business plan template pdf.

You can download our free franchise business plan template PDF here. This is a sample franchise business plan template you can use in PDF format. You can easily complete your business plan using our Franchise Business Plan Template here .

Franchise Business Plan FAQs

What is a franchise business plan.

A business plan is a plan to start and/or grow your franchise business . Among other things, it outlines your business concept, identifies your target audience , presents your marketing strategy and details your financial projections..

What Are the Main Sources of Revenues and Expenses for a Franchise Business?

The main sources of revenue for a business franchise are franchise fees and royalty fees. Some also earn from other fees like distribution fees, site assistance fees, training fees, technologies, and rebates.

The key expenses for franchises are inventory, payroll, marketing and advertising, rent and loans.

How Do You Get Funding for Your Franchise Business?

Among the most common sources of funding for a franchising business are commercial bank loans, Small Business Administration (SBA) loans, personal savings and friends and family loans/gifts. There are also lenders that can supplement other loans with equipment financing and business lines of credit for franchise businesses.

This is true for a business plan for a franchise restaurant, a business plan for franchise store, or any other franchise business plans.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Start a Franchise

9 min. read

Updated January 5, 2024

Franchising offers a pathway to business ownership that takes advantage of a proven idea and strong brand. You lose some autonomy and control—but get to work from an established playbook, learn from a successful franchisor, and, most notably not have to start a business from scratch .

So, is becoming a franchisee the best way to start a business?

Learn how to choose and start a franchise that fits your interests.

- What is a franchise?

A franchise is a business owned by an individual (franchisee) but branded and supervised by a larger company (franchisor). Common examples include Subway, 7-11, and Hilton Hotels.

Purchasing a franchise grants you the right to use a tested business model, pricing, products, and marketing strategies.

Additionally, franchisees gain access to the company’s trademarked materials like logos and slogans—essential for establishing a brand identity.

- How to start a franchise

While you get to bypass idea creation , customer validation , and brand development —there are still critical steps unique and similar to starting any other business.

1. Know your budget

There is always an upfront franchise fee, and franchisors often have financial requirements for potential franchisees. For example, some franchisors require franchisees to have a particular net worth.

Review your finances and assets to look for opportunities in line with your price range. Determine how you’ll finance the franchise, whether through personal savings, bank loans, or franchisor financing options.

2. Do your research:

You don’t want to waste time dreaming up your plans to open a specific franchise only to look at the fine print and realize it’s not a good fit.

For example: A Cafe Yumm franchisee must have a net worth of $500,000. If that isn’t where you’re at financially, look elsewhere.

Contact a current franchisee to learn more about the business if you can. What are their perceived pros and cons? What’s it like working with this brand? Are there any significant costs associated with this franchise?

Additionally, you need to check if a franchise is already running in your area. If so, the franchiser may be unlikely to approve another location in such close proximity.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Participate in an interview

A unique aspect of starting a franchise is that it’s not entirely up to you. You have to interview, almost like you’re applying for a job.

The format will depend on which franchiser you choose. The goal will be for you and the franchisor to review the specifics and determine if the franchise is right for you.

Take note of how much support the franchisors offer during setup and if they provide ongoing training.

4. Write a business plan

A benefit of starting a franchise is that many important aspects are well-established. However, you still need a business plan to cover how you will run your business, forecast sales and expenses, and outline employee needs.

Most importantly, you need a thorough market analysis that shows how this franchise will work in your local market. At a minimum, you need to detail who your target customers are and how they relate to or differ from the current franchise customer base. Luckily, most franchises offer assistance with this part of the process.

Check out our business planning hub to learn more about writing a franchise business plan .

5. Choose a suitable franchise location

Selecting a location can be complicated by specific requirements from the franchise owner. Size, setup, and even the atmosphere surrounding the business may limit your options.

Then, you must consider if the location makes sense from a performance standpoint.

- Is it going to attract your core customer base?

- Is there enough foot traffic?

- Is your business easily accessible?

Hopefully, the franchisor will assist in this process. If not, check out our complete guide on selecting a business location for more specific steps.

6. Sign the franchise agreement and review the FDD

Before you sign a binding contract outlining mutual obligations between you and the franchisor—you need to review the Franchise Disclosure Document (FDD) document.

The FDD contains a wealth of information, including:

- The franchisor’s background: History, business experience, and any litigation or bankruptcy history.

- Financial statements: Provides a clear picture of the franchisor’s financial health.

- Initial and ongoing costs: Details about the initial franchise fee, training costs, grand opening costs, royalty fees, and other related expenses.

- Training and assistance: Information on the training and support the franchisor will provide.

- Franchisee obligations: What is expected of the franchisee in terms of purchasing equipment, maintaining standards, advertising, etc.

- Territory: Whether the franchisee will have exclusive rights to a territory and the specifics of any territorial protection.

- Trademarks: Information about the franchisor’s trademarks, copyrights, and proprietary information.

- Renewal, termination, and transfer: The terms under which the franchise relationship can be renewed, terminated, or transferred.

- List of current and former franchisees: Contact information for current franchisees and those who have left the system recently.

- Earnings claims: If provided, details about the financial performance of existing units, though not all franchisors include this information.

- Restrictions: Details on any restrictions on what can be sold, sourcing and supply, and territory.

Before signing the FDD, review it carefully, preferably with the help of a lawyer .

7. Make your business legal

Aside from the franchise agreement and FDD, additional legal requirements exist to start your franchise.

- Set up a business structure: The franchisor may specify which business structure you must use.

- Federal and state registrations: At a minimum, you must apply for federal and state tax IDs. However, there may be additional requirements depending on your location.

- Business licenses & permits: Depending on the location and nature of the franchise, various local, state, or federal licenses and permits may be required.

- Tax registrations: Franchisees must register for appropriate federal, state, and local tax identification numbers and comply with tax obligations.

- Insurance requirements: Franchisees often need various insurance coverages, such as liability, property, workers’ compensation, and more, as mandated by law or the franchisor.

8. Stay updated on franchisor policies

Most franchisors provide training programs for new franchisees that cover everything from business operations to customer service.

However, this initial training may not cover everything, and franchisors may update their policies, marketing strategies, or product offerings.

Staying aligned with these changes ensures brand consistency and can impact the franchise’s success.

Dig deeper:

Should you open a franchise or start a business?

If you’re reading this, you’re likely more interested in opening a franchise than starting a new business. To be sure of your decision, let’s weigh the pros and cons of both options.

Things to consider when comparing franchise opportunities

Choosing the right franchise can be as challenging as developing a good business idea. Simplify the process and use these seven factors to help vet and select the right franchise.

History of franchising

Become familiar with how franchising has evolved into the business model it is today.

- Common types of franchises

Franchising spans a wide range of industries. While there are countless specific franchise concepts—you can group them into several common categories:

Food and beverage

Establishments that prepare and serve meals and drinks, ranging from quick-service to full-service dining.

- Fast-food restaurants (e.g., McDonald’s, Subway)

- Sit-down restaurants (e.g., Applebee’s, IHOP)

- Coffee shops (e.g., Dunkin’ Donuts)

- Ice cream and dessert parlors (e.g., Baskin-Robbins, Dairy Queen)

Businesses that sell goods directly to consumers from physical locations offering a variety of tangible products.

- Convenience stores (e.g., 7-Eleven)

- Specialty stores (e.g., The UPS Store, GNC)

Franchises providing specialized services to individuals or businesses—emphasizing expertise or personalized care.

- Home services (e.g., Molly Maid, Mr. Handyman)

- Automotive services (e.g., Jiffy Lube, Midas)

- Health and fitness centers (e.g., Anytime Fitness, Gold’s Gym)

- Educational services (e.g., Kumon, Sylvan Learning)

Business-to-Business (B2B)

Franchises that cater to other businesses, offering services that enhance business operations or efficiency.

- Printing and promotional services (e.g., Minuteman Press, FastSigns)

- Professional consulting and coaching (e.g., ActionCOACH)

- Commercial cleaning (e.g., Jan-Pro, Coverall)

Real estate

Operate in the property market, assisting in buying, selling, or leasing properties, with a focus on market expertise.

- Coldwell Banker

Franchises that provide accommodations for travelers, including hotels and motels, emphasizing comfort and amenities.

- Hilton Hotels

- Marriott International

- Holiday Inn

Personal care

Focus on enhancing appearance and well-being, offering services like grooming, beauty treatments, and wellness.

- Hair salons (e.g., Great Clips, Supercuts)

- Spas and beauty treatments (e.g., Massage Envy)

Centered around leisure and entertainment, providing venues or services for relaxation and fitness.

- Children’s entertainment centers (e.g., Chuck E. Cheese’s)

- Fitness and recreational sports centers (e.g., Planet Fitness, Club Pilates)

Cater to niche markets or unique services not covered in other categories, such as specific demographics or specialized needs.

- Pet services (e.g., Petland, Dogtopia)

- Restoration and disaster recovery services (e.g., SERVPRO)

- What franchise should you choose?

It can be quite challenging to choose a franchise since there are over 3,000 different concepts available.

How do you narrow it down to one? Here are three tips:

1. Figure out what you’re good at

While you’re not coming up with a business idea , you can still use the same tactics to identify a winning franchise opportunity. The easiest place to start is by identifying and listing out your skills, strengths, and passions.

Maybe you’re a relationship-builder, an operations expert, or already have experience working with a franchise.

If you’re struggling to identify what you’re good at, consider conducting a SWOT analysis on yourself. This will give you a structured way to assess your strengths, weaknesses, opportunities, and threats.

2. Match your skills to franchise opportunities

Use your skills as a reference when exploring franchise opportunities. Remember, you must be a good match for the franchise owner.

Having industry-specific experience or skills can help sell them on your ability to run their specific type of business.

For instance, if you’re drawn to a commercial cleaning franchise because it’s B2B and aligns with your sales skills.

3. Keep an eye on market trends

Be vigilant about consumer and business trends to ensure your franchise choice is relevant.

Take note of popular opportunities, but don’t jump on them immediately. Do your due diligence and determine if the franchise trend is sustainable and not a fleeting fad.

As always, fall back on market research to understand consumer spending habits. If the franchise category you’re interested in shows customers straying away from known brands—it may not be the right time to jump in.

- Start your franchise

Cooking up a brand new business idea has its value, but there’s no reason you can’t piggyback on a time-tested method and reap the benefits—as many franchisees are already doing today.

If you’re interested in buying a franchise to start or run your own business, learn all you can before you buy.

With planning and thoughtful execution, a franchise business can be just as rewarding as any other startup.

Check out our complete guide on starting a business to ensure you’re prepared to open a successful franchise.

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

Related Articles

7 Min. Read

Do You Need Small Business Accounting Software in 2024?

3 Min. Read

3 Reasons Why You Shouldn’t Wait to Register for a DBA

11 Min. Read

Starting a New Business After Bankruptcy in 7 Steps

4 Min. Read

Are You Cut Out to Run a Kennel or Pet Boarding Business?

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Franchise Business Plan: 7 Elements That You Should Know

- May 12, 2020

Developing a franchise business plan is an important part of becoming a franchisee (or a franchisor, expanding an existing franchise). This blueprint serves as a guide, focusing on the essential components of the business such as its goals, tactics, financial information, and operational structure.

A franchise business plan is an essential tool for franchisees, serving as a vital resource for both aspiring and current business owners. It helps secure funding, attract potential franchisees , and steer your road to success.

In this blog post guide, we will go over what a franchise business plan is, why it is important, and the seven main sections that every business owner should have in their plan. So, whether you are an experienced businessperson or a small business owner embarking on your franchise journey, this extensive guide will arm you with the knowledge you need, ensuring you have a winning plan for your franchise.

Why Does Franchise Business Matter?

A franchise business plan is a comprehensive document detailing your vision, strategies, and operations for a franchise. The franchise disclosure document ( FDD ) is crucial as it provides critical information needed for various sections of the plan, such as company description, market analysis, and financial projections. It serves critical purposes:

- Securing Financing: Investors and lenders require detailed business plans before funding.

- Attracting Franchisees: A compelling plan demonstrates your business potential.

- Providing Direction: It aligns your team and defines benchmarks for success.

- Responding to Market Trends: Helps you adapt and remain competitive in changing markets.

Ready to Be Your Own Boss?

7 elements of a successful franchise business plan.

The following seven key elements will guide you in creating a strong foundation for franchise success . Additionally, utilizing a franchise business plan template can provide a structured approach to outlining your goals and strategies effectively.

1. Executive Summary

The executive summary is the first impression of your franchise business plan, and it sets the stage for what’s to come. Think of it as the “elevator pitch” for your franchise, offering a high-level overview that’s both concise and compelling.

This is where you capture the attention of potential investors, franchisees, or stakeholders by presenting the essence of your business in an engaging way.

Key Contents to Include:

- The name of your franchise and its location.

- A description of the products or services you offer.

- Your mission statement—what drives your business—and your vision for the future.

- An overview of your target market.

- A clear explanation of your unique selling proposition (USP)—what sets your franchise apart from competitors.

- Your competitive advantage and why it matters.

How to Create It: Focus on what makes your franchise unique and valuable. Imagine you have one minute to explain why your business idea is a winning one—what would you say?

Highlight your goals, your strategy, and why your franchise is poised for success. Remember, this section often determines whether the reader will continue to dive deeper into your business plan.

2. Business Description

In the business description, you have the opportunity to paint a complete picture of your franchise’s identity. It is crucial to provide a detailed description of business operations, highlighting how the management structure and day-to-day activities must be clearly defined to ensure efficiency and strategic execution.

This is where you tell the story of your business—its origins, structure, and aspirations.

- A brief history of your company. How did the business start? What inspired it?

- The legal structure of your franchise, such as whether it’s a sole proprietorship, partnership, or LLC.

- An overview of the industry, including key trends and how your franchise fits into the current landscape.

- Long-term goals for your franchise, including plans for growth and expansion.

How to Create It: This section is about creating a narrative. Describe not just what your business does, but why it exists and what drives it.

For example, explain how your franchise addresses a gap in the market or fulfills an unmet need. Use data to showcase how your franchise aligns with industry trends and what makes it relevant for today’s market.

3. Competitive Analysis

A strong competitive analysis shows that you understand your market and know how to carve out a unique space within it. This section isn’t just about listing competitors ; it’s about demonstrating your ability to stand out and win.

- A list of competitors, both direct and indirect.

- Comparisons of pricing, products, services, and other differentiating factors.

- An analysis of competitors’ strengths and weaknesses.

- Your strategies to gain a competitive edge.

How to Create It: Start by researching your competitors thoroughly—visit their locations, review their online presence, and assess their offerings.

Identify what they do well and where they fall short. Then, articulate how your franchise fills gaps or does things differently, whether that’s through innovative products, superior customer service, or a unique pricing model.

4. Marketing and Sales Plan

Your marketing strategy and sales plan outlines how you will attract, engage, and retain customers through a detailed marketing plan. It’s also where you show how you’ll generate revenue and grow your customer base over time. A well-defined sales strategy is crucial for generating revenue and achieving overall business success.

- A detailed profile of your target market. Who are your ideal customers? What are their needs and preferences?

- The marketing strategies you’ll use, such as social media campaigns, local events, or partnerships.

- Your sales approach, including pricing models, promotions, and customer incentives.

- Plans for creating and distributing marketing materials that reflect your franchise’s brand identity.

How to Create It: Start with a deep understanding of your target audience. What are their pain points, and how does your franchise solve them?

Outline specific goals, such as increasing brand awareness or driving foot traffic, and describe the steps you’ll take to achieve them. Be sure to include measurable metrics to track success.

5. Operations and Management

The operations and management section focuses on how your franchise will run on a day-to-day basis. It also highlights the leadership and expertise behind the business.

- A breakdown of your operational processes, from supply chain logistics to customer service protocols.

- The structure of your management team, including roles and responsibilities.

- Staffing and training plans to ensure your team is equipped to deliver on your franchise’s promises.

- Contingency plans for handling challenges like supply shortages or staff turnover.

How to Create It: Be specific about how your franchise will operate. Include examples of how your team will manage daily tasks, from opening the business to serving customers.

Highlight the qualifications and expertise of your management team and explain how their leadership will contribute to the franchise’s success.

6. Financial Plan

The financial plan is one of the most critical sections of your business plan, emphasizing the importance of detailed financial projections. It provides a clear picture of your franchise’s economic outlook and funding needs.

- Startup costs, including franchise fees, equipment, and initial inventory.

- Revenue projections for the first three to five years.

- A detailed breakdown of expected expenses, including rent, salaries, and marketing costs.

Financial statements such as profit and loss (P&L), balance sheets, and cash flow projections.

How to Create It: Work with financial experts or accountants to create realistic and detailed projections. Show how your franchise will achieve profitability and how you’ll use any funding you secure.

This section should leave no doubt in the reader’s mind about the financial viability of your business .

7. Pro Forma Financial Statements

Pro forma financial statements provide a forward-looking view of your franchise’s financial health. These projections demonstrate your ability to generate revenue and manage costs.

- A projected balance sheet showing your franchise’s assets, liabilities, and equity.

- A cash flow statement detailing how money will flow in and out of the business.

- An income statement projecting profits and losses over a specific period.

How to Create It : Use a combination of historical data (if available) and industry benchmarks to create accurate projections.

Collaborate with financial advisors to ensure these statements are thorough and credible. Investors rely on this section to gauge the potential success of your franchise.

How to Keep Your Franchise Business Plan Updated

A franchise business plan is a living document, serving as the foundation for your franchise’s growth and success. Regular updates ensure it remains relevant and effective in guiding your franchise operation.

To maximize the plan’s value, it is essential to develop a customized approach that aligns with your specific franchise needs while consistently reflecting changes in your business environment. Here’s how to ensure your business plan remains up-to-date and actionable, while effectively managing your franchise brand’s day-to-day operations:

Monitor Financials

Keep a close eye on your financial performance by comparing actual revenue figures against your projections. Understanding how much revenue your business generates and where discrepancies lie can help you fine-tune your pricing strategy and operational goals.

Adapt to Industry Trends

Stay informed about shifts in customer preferences and broader industry changes. By aligning your sales strategies with the latest trends, you can maintain competitiveness and drive business growth.

Refine Marketing Approaches

Continuously assess and adjust your marketing strategies to focus on the most effective channels. This refinement helps to maximize return on investment and ensure your efforts resonate with your target audience.

Update Operations

Regularly optimize your business processes to enhance efficiency. Whether your franchise ownership involves direct management or delegation, streamlining operations can positively impact overall performance and profitability.

Consult Experts

Leverage the expertise of professionals, such as those from the Small Business Administration or franchise consultants, to gain new insights. Their advice can help you tackle challenges and uncover opportunities you may have overlooked.

Evaluate Pricing Strategy

Reassess your pricing strategy regularly to ensure it aligns with market conditions and customer expectations. A thoughtful approach to pricing not only supports revenue goals but also fosters customer loyalty.

By following these steps, you ensure your own business plan evolves alongside your business, helping you stay ahead in a competitive landscape while driving sustainable growth.

A well-crafted franchise business plan is your roadmap to success. By including critical elements like market analysis, financial details, and operational strategies, you can secure funding, attract franchisees, and build a sustainable business.

Whether you’re a budding entrepreneur or looking to expand your franchise businesses, this guide provides the framework for crafting a plan that sets your franchise apart. Take the next step by consulting a franchise expert to refine your strategy and unlock new growth opportunities.

Recent Posts

7 steps to career transition into franchise ownership, how to increase your chances for franchise success, why mindset matters to franchisee success – explained, protect your wealth from stock volatility with franchise investments, why athletes who own franchises dominate the business game, 12 construction franchise opportunities worth investing in 2024.

Written by Adam Goldman

Adam Goldman is an experienced entrepreneur with over 20 years in business, startups, and franchising, founding three successful companies across two continents. Adam holds an M.B.A. in entrepreneurship from UC Berkeley and enjoys training for triathlons while serving on the local board of the Entrepreneur’s Organization.

© Copyright 2023 franchisecoach.net All rights reserved.

Privacy policy.

IMAGES