JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Newly Launched - AI Presentation Maker

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Letter Of Credit PowerPoint Presentation Templates in 2024

A Letter of Credit (LC) is a financial document issued by a bank on behalf of a buyer that guarantees payment to a seller once certain conditions are met. This widely used payment method in international trade provides security for both parties involved in a transaction. The buyer is assured that the seller will only receive payment if the terms of the agreement are fulfilled, while the seller is guaranteed payment as long as the specified documents are presented. LCs help mitigate the risk of non-payment and ensure smooth transactions across borders. They are particularly useful in cases where the buyer and seller are unfamiliar with each other or when dealing with high-value transactions. LCs can also be used to provide financing for the buyer or as a means of securing goods in transit.

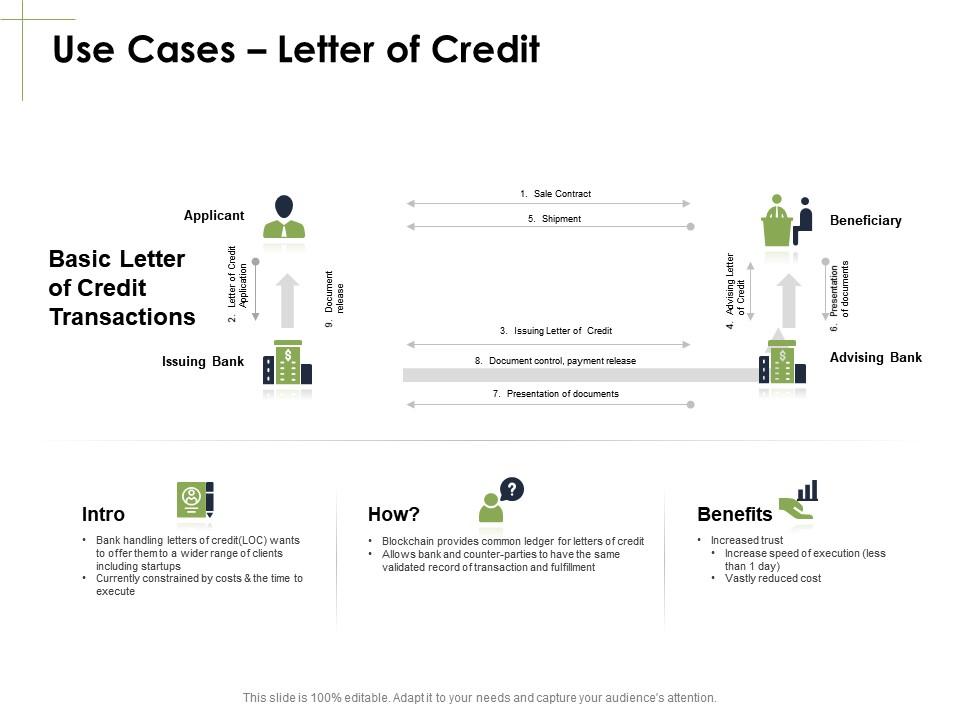

Use cases letter of credit sale marketing ppt powerpoint presentation gallery ideas

Presenting this set of slides with name Use Cases Letter Of Credit Sale Marketing Ppt Powerpoint Presentation Gallery Ideas. The topics discussed in these slides are Sale, Benefits, Strategy, Planning, Management. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Bring an end to existing friction with our Use Cases Letter Of Credit Sale Marketing Ppt Powerpoint Presentation Gallery Ideas. Identify factors creating discord.

Related Products

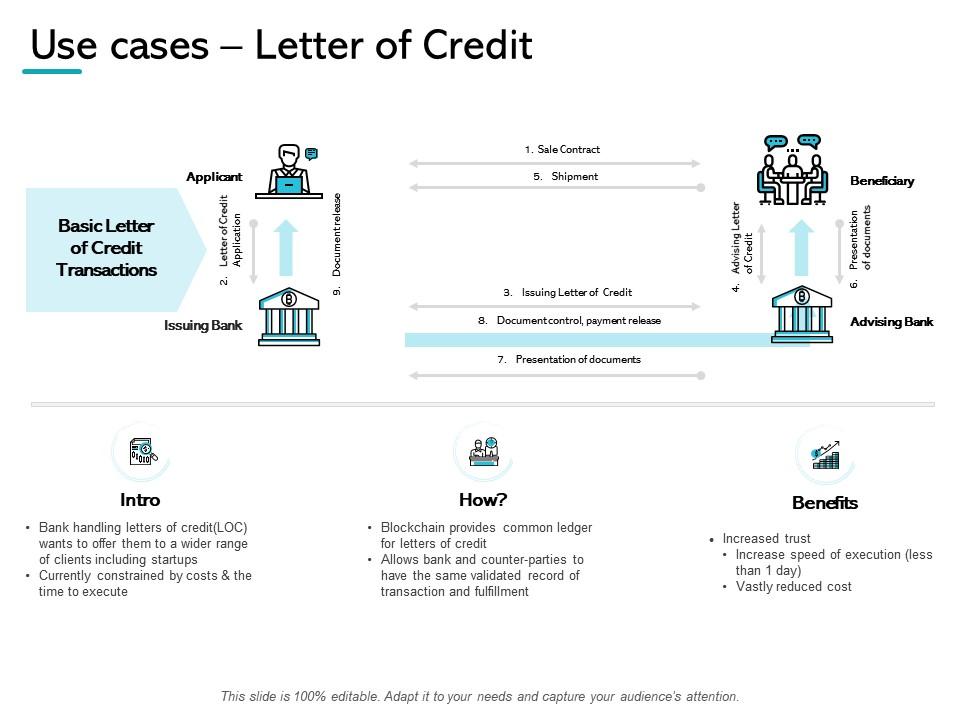

Use cases letter of credit shipment ppt powerpoint presentation pictures designs

Presenting this set of slides with name Use Cases Letter Of Credit Shipment Ppt Powerpoint Presentation Pictures Designs. The topics discussed in these slides are Marketing, Business, Management, Planning, Strategy. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Invigorate the crowds with our Use Cases Letter Of Credit Shipment Ppt Powerpoint Presentation Pictures Designs. Generate an intense feeling of enthusiasm.

Use cases letter of credit benefits sale ppt powerpoint presentation gallery sample

Presenting this set of slides with name Use Cases Letter Of Credit Benefits Sale Ppt Powerpoint Presentation Gallery Sample. The topics discussed in these slides are Benefits, Sale, Marketing, Management, Business. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Build firm faith in your commitment with our Use Cases Letter Of Credit Benefits Sale Ppt Powerpoint Presentation Gallery Sample. Be able to earn their friendship.

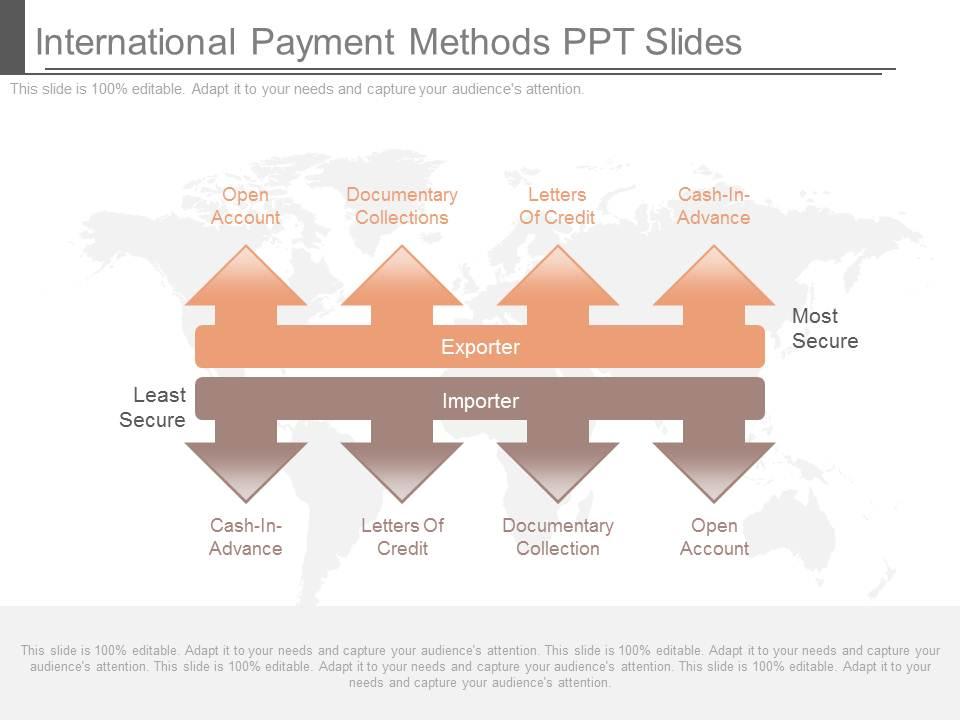

See international payment methods ppt slides

Presenting see international payment methods ppt slides. This is a international payment methods ppt slides. This is a two stage process. The stages in this process are open account, documentary collections, letters of credit, cash in advance, most secure, open account, documentary collection, letters of credit, cash in advance, least secure, exporter, importer.

Display ability to cope with our See International Payment Methods Ppt Slides. Demonstrate that nothing can faze you.

- Open Account

- Documentary Collections

- Letters Of Credit

- Cash In Advance

- Most Secure

- Documentary Collection

Process Letter Credit Ppt Powerpoint Presentation Slides Ideas Cpb

Presenting our Process Letter Credit Ppt Powerpoint Presentation Slides Ideas Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Process Letter Credit. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Our Process Letter Credit Ppt Powerpoint Presentation Slides Ideas Cpb are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Process Letter Credit

App letter of credit business funding ppt presentation

Presenting app letter of credit business funding ppt presentation. This is a letter of credit business funding ppt presentation. This is a four stage process. The stages in this process are letter of credit, confirming bank, structured trade finance, trade finance.

Buy into your dreams with our App Letter Of Credit Business Funding Ppt Presentation. They will be your first deposit.

- letter of credit

- confirming bank

- structured trade finance

- Trade Finance

International business trade payment sample presentation ppt

Presentation design accessible in standard and widescreen view. Entirely compatible PPT template with Google slides. Choice to get similar designs with different nodes and stages. Modification is possible with PowerPoint slides. Can be quickly converted into JPEG and PDF document. Suitable for businesses. The stages in this process are documentary collections, seller, cash in advance, letter of credit, buyer, open account, least desirable, most desirable, least desirable, most desirable.

Choose our International business trade payment sample presentation PPT slide for your next presentation. The PowerPoint design has been crafted by the team of efficient designers. The template comes with different stages in this process such as documentary collections, seller, cash in advance, letter of credit, buyer, open account, least desirable, most desirable, least desirable and most desirable. If you are planning to expand your business in the global market requires then you need to take each and every step with the complete attention. Our PPT diagram can be used to demonstrate different types of payment methods available in international trade, payment options in export import trade, instruments of payments in global business etc. The concept of buying and selling can be easily highlight with the presentation design. Exporters always want to receive payment as soon as possible sometimes even before delivery. Download the design to display the aspect in the great way.Functional concepts emerge with our International Business Trade Payment Sample Presentation Ppt. Concurent beliefs get a firm boost.

- Least Desirable

- Most Desirable

Letter of credit business funding ppt presentation examples

Presenting letter of credit business funding ppt presentation examples. This is a letter of credit business funding ppt presentation examples. This is a four stage process. The stages in this process are letter of credit, confirming bank, structured trade finance, trade finance.

Halt the abuse with our Letter Of Credit Business Funding Ppt Presentation Examples. Bring an end to all exploitation.

Closed letter box with three letters inside

Presenting this set of slides with name - Closed Letter Box With Three Letters Inside. This is a three stage process. The stages in this process are Box Slides, Carton Slide, Pack Slide.

Churn your thoughts with our Closed Letter Box With Three Letters Inside. Whip up a mix they cannot resist.

- Carton Slide

Letter inside envelope vector icon

Presenting letter inside envelope vector icon. This is a letter inside envelope vector icon. This is a two stage process. The stages in this process are envelope icon, post office icon, letter icon.

Build up huge capital with our Letter Inside Envelope Vector Icon. Increase deposits to your bank account.

- Envelope Icon

- Post Office Icon

- Letter Icon

LETTER OF CREDIT

Aug 23, 2014

1.76k likes | 3.47k Views

LETTER OF CREDIT. LETTER OF CREDIT /DOCUMENTARY CREDIT.

Share Presentation

- transferable

- nominated bank negotiating bank

- capital cycle

- beneficiary seller

- advising bankhas

- deferred payment undertaking

Presentation Transcript

LETTER OF CREDIT /DOCUMENTARY CREDIT Letter of Credit is an undertaking issued by a Bank (Issuing Bank), on behalf of the buyer (the importer), to the seller (exporter) to pay for goods and services provided that the seller presents documents which comply with the terms and conditions of the Letter of Credit

LETTER OF CREDIT UCPDC – 600 Edition effective from 1st July 2007 Documentary Credit means any arrangement that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honoura complying presentation.

Complying presentation • a presentation that is in accordance with • the terms and conditions of the credit, • the applicable provisions of these rules (UCP 600) and • international standard banking practice. • Honour • a. to pay at sight if the credit is available by sight payment. • b. to incur a deferred payment undertaking and pay at maturity if • the credit is available by deferred payment. • c. to accept a bill of exchange ("draft") drawn by the beneficiary and pay at maturity if the credit is available by acceptance. 4

LETTER OF CREDIT • Three main contracts underlying LC - Sale Contract between Buyer & Seller - Application-cum-Guarantee between Applicant(Buyer) and Issuing Bank - LC itself (contract between Issuing Bank and Beneficiary/Seller) ( LC independent of other two contracts)

GOODS EXPORTER IMPORTER Letter of Credit OPENS CREDIT DOCUMENTS DOCUMENTS PAYMENT PAYMENT Mechanics of Documentary Credit CONTRACT GOODS DOCS DOCS Advising bank Negotiating Bank/ Confirming Bank Reimbursing Bank 6

Parties to Letter of Credit • Opener/Buyer • Issuing Bank • Advising Bank • Beneficiary/Seller • Nominated Bank/Negotiating Bank • Confirming Bank • Reimbursing Bank

Types of credit Security to beneficiary Confirmed Mode of settlement Payment/ deferred payment Acceptance Negotiation Involving middlemen Transferable Back to back Involving advances Red Clause Credit Green Clause Credit Involving repeated transactions Revolving Stand by 9

Transferable Credits Credit has to be opened as transferable The beneficiary is normally a trader or agent He transfers credit to his supplier - second beneficiary. Transferred by a bank at the request of first beneficiary Second beneficiary can supply goods and negotiate documents as if he had received the credit. He may pay commission to first beneficiary for the order There can be more than one second beneficiary. No third beneficiary is permitted. 10

Transferable Credits The following parameters may be changed while transferring a credit Amount of credit, unit price and quantity of goods Date of expiry, last date of shipment and last date of negotiation can be brought forward % of insurance cover may be increased. First beneficiary has the right to substitute documents negotiated by second beneficiary. 11

Back to Back Credits Exporter receives a credit from his buyer ( Selling credit) He has to procure goods from other suppliers He opens a credit for purchase of the goods ( buying credit) Second credit is said to be back to back to the first one. Bill proceeds of the export LC (Selling LC) will be used to meet liabilities under the second (Buying LC) Amount of back to back credit will be lower. Usance period of the back to back credit should be equal to or more than that of the export credit. Bank still at risk if the customer fails to export No concession in margin and security norms. 12

Revolving Credits Credit is opened to cover a series of regular transactions over a longer period Beneficiary will submit a series of documents Maximum value of each document will be fixed and is the revolving limit LC amount is the maximum value of documents that can be handled under the credit. The credit may be reinstated automatically or after payment of earlier bill. It can be opened as cumulative or non cumulative. 13

Standby Letters of Credit • Credit is issued for a particular amount and for a particular period • Trade takes place on running account basis. • Beneficiary does not submit documents to bank. • If there is a default, he can claim funds from opening bank giving a certificate of default • No quibbling over discrepancies and documents • Opening bank will pay on demand • Works like a bank guarantee • UCPDC is applicable if so declared in the credit

LC Regulations • Foreign Trade Policy requirements. • FEMA requirements. • Credit norms of Central Bank. • UCPDC 600 Provisions. • Bank’s Internal Credit Policies/ procedures. • Public notices issued by DGFT • Uniform Rules for bank-to-bank reimbursements 525 • Incoterms 2010

Bank’s Obligation & Responsibilities • Issuing Bank (opening bank) ( UCP Article 7) -the prime obligator -to ensure credit-worthiness and trust-worthiness of the applicant - Once credit is opened, the bank is placing itself as a substitute for the buyer.

Bank’s Obligation & Responsibilities • Advising Bankhas the obligation to authenticate the credit once it is received and passing it promptly on to the beneficiary ( Art.9). • Confirming Bank takes over the responsibilities of the issuing bank as far as the beneficiary is concerned though it has got recourse to the Issuing Bank (Art 8).

Bank’s Obligation & Responsibilities Negotiating Bank • to examine docs. Within 5 banking days after receipt of the documents at their counters(Art 14b). • to ensure compliance of credit terms ( on the basis of documents alone) as well as consistency of docs with each other.

Protection to Banks • Banks are not responsible : • for the genuineness or contents of any documents submitted (Art. 34) • For losses etc. arising from transmission problems (Art. 35) • Force Majeure ( Art. 36) • For the failings of their correspondent Banks (Art. 37)

Protection to Banks • Issuing Bank is responsible for all Bank charges and other costs at home or abroad even if they are supposed to be paid by other party (Art. 37 c). • Applicant is responsible for any adverse consequences of foreign laws (Art. 37d).

LETTER OF CREDITAppraisal / Assessment • satisfactory track record. • dealings with only one bank. • Liabilities of the applicant to the Bank and third parties. • Means by which the applicant is expected to meet his commitment once the bills arrive. • Margin he should deposit.

Appraisal Issues.. • Limit to be commensurate with turnover and CC limits. • Should be for genuine trade/ manufacturing activity. • Usance period of the LC should ordinarily have relation to the working capital cycle. • Level of inventory carried should be commensurate with industry norms / past trends.

Appraisal Issues…. • LCs for purchase of machinery / capital goods should be backed by borrower’s own funds or a term loan sanctioned for the purpose. • Wherever warranted, in addition to margin, where prescribed, we may also retain a lien on the undrawn portion of the CC limit for the value of bills to be received under the LC.

Appraisal Issues • Sister concerns: • Where the opener and beneficiary are sister concerns, LCs should not normally be necessary. • Take care of kite-flying operations. • Standing of the beneficiary. • D/A facilities to applicants of undoubted standing and where security available is much more than the value of LC.

Appraisal Issues • While computing purchase of imported material on LC basis take net of import duty. • Assess limits for usance and sight LC separately. • Usance period should not exceed the production cycle excepting in the case of bulk imports. • Keep in mind the accepted projections regarding Sundry Creditor levels. • Margins & security depending on track record. • Cash budget monitoring to track availability of funds.

Appraisal Issues…. Revolving LCs: • To be valid for not more than 1 year • The limit should be a sub-limit. • The LC value should be restored for further negotiation only after the advice of retirement of the previous bill has been received from the issuing bank by the beneficiary bank.

ASSESSMENT OF LC LIMIT While assessing Letter of Credit Limit, the following points need to be noted: Purchases of RM on LC basis should be net of Import Duty; LC amount should cover FOB, CIF or C&F value of goods- should not include customs duty and other charges payable in India. Payment of these charges should be taken care of by the main working capital(CC) A/C of Applicant. Transit time should be treated as ‘Nil’ if usance period starts from shipment date.

Other issues Arriving at D.P: • Ensure that the stocks covered by bills which have been received under LCs opened by us, and not yet retired, are not included for computing the D.P. in CC account. Devolvement of LCs: • In case of irregularity in CC account do not open further LCs. • Take adequate margins and step up in case of it becoming a habit – in worse cases stop further issues. • Mark lien on DP so that usance bills are properly retired on due date.

Treatment of stocks covered by Usance LC • Lien should be earmarked against advance value of stocks for the outstanding usance LC bills. • This ensures provision of margins on the stocks covered by usance LCs right from the time the stocks are bought on credit backed by the Bank’s commitment. • Thus, it ensures that the margin is available well before the CC a/c is debited for the matured LC bill.

Treatment of stocks covered by Usance LC • In some cases it is quite possible that the units may not be in a position to provide margins right from the time of purchases against LCs. In such cases, based on merits, earmarking of lien for the value of usance LC billsoutstanding may be permitted against the aggregate ‘market value’ of stocks (including the LC stocks)instead of against the ‘advance value’ of securities.

Precautions • The limits for demand LCs and usance LCs should be assessed separately with ample justifications. • The usance period should not, generally, exceed the production cycle. • In case of bulk imports, establishment of LCs for longer usance period may be considered selectively. • When liability under LC is met by creating an irregularity in the Cash Credit account, the relative LC limit should not be released for opening further LCs till the account is adjusted. • Frequent Devolvement's: Warning signal!

Assessment of LC Limit • We assume that: - Annual consumption of material to be purchased under LC ……… C (Rs..) • Lead time from opening LC to shipment: L (months) - Transit time: T (months) - Credit (usance) period available: U (months)

Assessment of LC Limit • L+ T+ U = Purchase Cycle: P (months) • LC Limit = P x C/12 Say, lead time, i.e. time from order placement to shipment = 10 days Transit period = 20 days Usance period from arrival of goods= 3m Total Purchase Cycle = 4m Monthly consumption of material = Rs 100 lacs LC Limit(4 x 100) = Rs 400 lacs

ASSESSMENT OF LC LIMIT : M/s XYZ COMPANY LIMITED LETTER OF CREDIT LIMIT OF Rs. 20 CRORES (Rs. in crores)

Assessment of LC Limit • Let us assume as follows: (Rs in lacs) i) Annual purchase of RM: 3200 ii) RM purchase under LC(50%): 1600 iii) Purchase under demand LC: 800 iv) Purchase under usance LC: 800

Assessment of Demand LC Limit • Time gap from opening till shipment: 1 m • Transit period from date of shipment till date of retirement: 0.5 m • Demand LC Limit: 800 x 1.5/12 = Rs 100 lacs

Assessment of Usance LC Limit • Lead Time, i.e from opening LC till shipment: 1 month • Transit Period, i.e. from date of shipment till date of receipt of documents by importer: 0.5 months • Average usance period: 2 months • Usance LC Limit: 800x3.5/12= Rs 233 lacs

- More by User

Letter of Credit

Letter of Credit. Letter of Credit. Letter of Credit. An order is sent to the exporter. It is agreed that payment will be by letter of credit (L/C) Importer sends L/C application to his bank, the issuing bank

1.55k views • 5 slides

Letter of Credit Fraud

Letter of Credit Fraud. By: Sage Richards. What is a Letter of Credit?. Letter of Credit- A finical contract between bank, customer, and beneficiary (seller); that involves transfer of goods or services.

1.01k views • 7 slides

LETTER OF CREDIT CITD

LETTER OF CREDIT CITD. Methods of Payment. Methods of Payment. Cash in Advance Letters of Credit Documentary Collection Sight/Time Drafts aka D/P, D/A Open Account Risk mitigation: Export Credit Insurance Standby L/C’s. L /C. Goods. Cash in Advance.

607 views • 29 slides

Letter of Credit. Documents through Bank against payment i.e. DP After the sale contract is entered into, the seller dispatches the goods and prepares the various documents as required by the buyer and submits the same to his bank with instructions to send the same to the buyer’s bank.

601 views • 19 slides

Letter of Credit L/C

Letter of Credit L/C. 1.Customer and supplier agree on L/C as method of payment. Letter of Credit. 2.Customer gives order to open L/C. Letter of Credit. 3.Customer´s bank informs somebody about the opening of L/C. Letter of Credit. 4.Supplier´s bank confirms the credit to the supplier.

457 views • 12 slides

Letter of Credit. Contents. 5.1 An Overview of L/C. 5.2 Procedures of L/C. 5.3 Types of credit. 5.1 An Overview of L/C. 5.1.1 Definition of L/C 5.1.2 Contents of a L/C 5.1.3 Issuance Forms of L/C 5.1.4 Characteristics of a L/C 5.1.5 Parties involved in a L/C.

1.35k views • 69 slides

Chapter six Letter of credit

Chapter six Letter of credit. 6.1 An Overview of Letter of Credit 6.2 Parties to Letter of Credit 6.3 Procedures of documentary credit operation 6.4 Types of Letter of Credit 6.5 Inspection and Amendment of letter of credit 6.6 Amendment of Letter of Credit. Definition

1.27k views • 45 slides

Letter of Credit by Numerouno Consultants

Back to Back Letter of Credit is also termed as Countervailing Credit. A credit is known as back to back credit when an L/C is opened with security of another L/C.

753 views • 11 slides

Sample Credit Dispute Letter

We offer you sample credit repair letters that are effective for fixing your credit disputes. For more information simply click our “Stop Debt Collector” button and we will get back to you.Read More.. www.disputeallthree.com

3.62k views • 5 slides

Credit Dispute Letter - www.creditrepairright.com

Do credit dispute letters work? How can I improve my credit score? Get answer to all these questions and lot more here at http://www.creditrepairright.com/.

170 views • 6 slides

How Stand by Letter of Credit is Different From Letter of Credit?

Stand by letter of credit is different from letter of credit. Contact us for more details regarding SBLC standby letter of credit.

160 views • 12 slides

Letter of credit

This document is highly preferred as it is a customizable document. It can be easily modified based on the terms of the parties involved in the contract of trade. It ensures safety of payment as well as enhances the trust of importers and exporters in dealing internationally. A seller can avail pre-shipment finance so as to prepare and ship goods against the letter of credit. This document also ensures timely payment and help seller or the exporter plan their cash flows. At Myforexeye, import and export businesses can avail assistance related to buyeru2019s credit, supplieru2019s credit, export Factoring and export LC discounting. Visit: https://www.myforexeye.com/letter-of-credit/

175 views • 7 slides

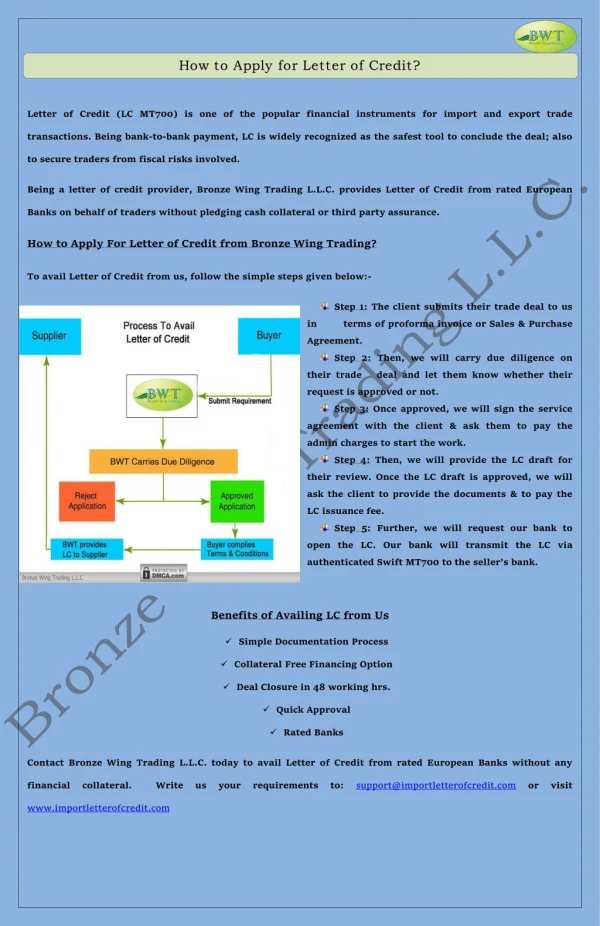

Letter of Credit Process: How to Apply Letter of Credit MT700?

Bronze Wing Trading L.L.C., the letter of credit providers in Dubai assist traders to conclude their trade deal by offering Letter of Credit MT700 from Rated Banks. To avail Letter of Credit on behalf of your company, write us your requirement to: [email protected] or visit https://importletterofcredit.com/letter-of-credit

46 views • 1 slides

201 views • 5 slides

Letter of Credit – LC MT700 – Letter of Credit Providers

The power point presentation presented by Bronze Wing Trading L.L.C., the Letter of Credit Providers in Dubai talks about u2013 What is Letter of Credit, Steps to Avail Letter of Credit, and Letter of Credit Benefits. To know more about Letter of Credit, Watch these slides! Do you require Letter of Credit to conclude your imports? Contact us today! We can help you by providing Letter of Credit MT700 on behalf of your company that allows you to conclude your trade deal in a safe and secure way! Submit your requirement online! Write to us: [email protected] or visit https://www.bwtradefinance.com/letter-of-credit-lc/

127 views • 8 slides

Letter of Credit Provider in Dubai

http://www.pnkprojectmanagement.com/ - Letter of Credit Provider in Dubai, UAE. PNK Project Management is a trade finance Letter of Credit Provider in Dubai company in Dubai, UAE that provides wide range of banking instruments including letter of credit, financial guarantee and all your trade finance

88 views • 6 slides

International Letter of Credit

A letter of credit is one of the most secure and safe financial tools to mitigate your payment risks in international trade & transactions. We at Emerio Banque offer all kinds of letter of credit services to the global importers/exporters. Types Of Bank Letter Of Credits Served by Emerio Banque 1. Revocable and Irrevocable LC 2. Confirmed and Unconfirmed LOC 3. Transferable and Un-transferable LC 4. Deferred or Usance LC 5. Red Clause LOC 6. Commercial LC 7. Standby Letter Of Credit 8. Back-to-Back LC etc. t Whether you are an importer or an exporter, A letter of credit can help both. It not only provides secured payment guarantee to the exporters but also helps the importer in availing short-term working capital for his business. Are you in the Import/Export business and looking for trade financial instruments? Let us tell your bank credit letter requirement and we will help you with our years of experience in import/export financing, Know more about letters of credit: What Is A Letter Of Credit And When To Use It? Find The Guide

100 views • 3 slides

Letter of Credit Service By Axios Credit Bank

Axios Credit Bank offers a letter of credit services to the global import/export businesses according to their financial requirements. Now importers can assure their suppliers with our letter of credit service and make easy and secure business transactions.

83 views • 4 slides

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Letter Of Credit and Its Basic Features

Published by Claude Newton Modified over 6 years ago

Similar presentations

Presentation on theme: "Letter Of Credit and Its Basic Features"— Presentation transcript:

INTERNATIONAL TRADE SERVICES

14. LETTERS OF CREDIT: PROCEDURES 1. LETTERS OF CREDIT I.THE NEED FOR LETTERS OF CREDIT A. USES TO THE SELLER WITH A FIRST-TIME CUSTOMER WITH A CREDIT.

LETTER OF CREDIT CITD SEMINAR

1 OUTLINE FOR CHAPTER 22 Understand –Basic needs of export/import financing –Main instruments (letter of credit, bill of exchange, and bill of lading)

Financing Foreign Trade

Financing the International Trade Export-Import Financing n Functions of Financing the trade: Managing the risk of completion of the transaction. Protection.

Credit risk management Foreign Trade Transaction Lecture 11th Dr. Katalin Csekő.

Lecture 12 FINANCING Topics covered: Scope of International Financing

PAYMENT TERMS ADVANCE PAYMENTS OPEN ACCOUNT TRADE

Methods of Payment. The problem with this method includes: Delays in payment Risk of nonpayment Cost of returning merchandise Limited sales effort.

15 LETTERS OF CREDIT: TYPES AND USES. CHAPTER 14 LETTERS OF CREDIT: TYPES AND USES I. COMMERCIAL CREDITS A. Certainty of Commitment 1. Irrevocable amendment.

Unit 10. Methods of International Settlements. International money transactions refer to the movement of funds from one country to another. The main reason.

INTERNATIONAL TRADE FINANCE Topics to be Discussed in Chapter –Letter of Credit Uniform Customary and Practices for Documentary Credits –Standby Letters.

Letter of Credit or documentary credit. It consists of a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and.

1 GETTING PAID BY YOUR FOREIGN BUYER Presented By Nellie Smith Vice President Global Trade Services.

International Trade & Role of Financial Institutions

Presented to: Western Maquiladora Trade Association April 15, 2009 Introduction of Basic Terms of Trade Payment.

Export Finance Needs After obtaining an export order, finance would be needed for: Procurement of raw materials and components and manufacture of the.

COTPrepared by Leng kimhok1 Chapter 12: Methods of Payment Principle payment methods are: Invoice Payment with order Documentary collection Documentary.

CH1 INTERNATIONAL TRADE CONTRACTS

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

- Preferences

LETTER OF CREDIT - PowerPoint PPT Presentation

- LETTER OF CREDIT

Title: Letters of Credit Author: sba Last modified by: ADMIN Created Date: 3/10/2006 9:37:22 PM Document presentation format: On-screen Show (4:3) Other titles – PowerPoint PPT presentation

- Letter of Credit is an undertaking issued by a Bank (Issuing Bank), on behalf of the buyer (the importer), to the seller (exporter) to pay for goods and services provided that the seller presents documents which comply with the terms and conditions of the Letter of Credit

- UCPDC 600 Edition effective from 1st July 2007

- Documentary Credit means any arrangement that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

- Complying presentation

- a presentation that is in accordance with

- the terms and conditions of the credit,

- the applicable provisions of these rules (UCP 600) and

- international standard banking practice.

- Three main contracts underlying LC

- - Sale Contract between Buyer Seller

- - Application-cum-Guarantee between Applicant(Buyer) and Issuing Bank

- - LC itself (contract between Issuing Bank and Beneficiary/Seller)

- ( LC independent of other two contracts)

- Opener/Buyer

- Issuing Bank

- Advising Bank

- Beneficiary/Seller

- Nominated Bank/Negotiating Bank

- Confirming Bank

- Reimbursing Bank

- Financial documents Drafts (ISBP Para 43 to 56)

- Transport documents BL, AWB etc

- (UCP Articles 19 to 27, ISBP Para 68 to 169)

- Insurance documents Certificate/ policy

- (UCP Article 28, ISBP Para 170 to 180)

- Commercial documents Invoices

- (UCP Article 18, ISBP Para 57 to 67)

- Miscellaneous documents All other documents

- Certificate of origin, Packing list, Quality certificate etc.

- Documents other than invoices, transport and insurance documents are not defined by UCPDC

- Only Certificate of Origin dealt with under ISBP Para 181 to 185

- Security to beneficiary

- Mode of settlement

- Payment/ deferred payment

- Negotiation

- Involving middlemen

- Transferable

- Back to back

- Involving advances

- Red Clause Credit

- Green Clause Credit

- Involving repeated transactions

- Credit has to be opened as transferable

- The beneficiary is normally a trader or agent

- He transfers credit to his supplier - second beneficiary.

- Transferred by a bank at the request of first beneficiary

- Second beneficiary can supply goods and negotiate documents as if he had received the credit.

- He may pay commission to first beneficiary for the order

- There can be more than one second beneficiary.

- No third beneficiary is permitted.

- The following parameters may be changed while transferring a credit

- Amount of credit, unit price and quantity of goods

- Date of expiry, last date of shipment and last date of negotiation can be brought forward

- of insurance cover may be increased.

- First beneficiary has the right to substitute documents negotiated by second beneficiary.

- Exporter receives a credit from his buyer ( Selling credit)

- He has to procure goods from other suppliers

- He opens a credit for purchase of the goods ( buying credit)

- Second credit is said to be back to back to the first one.

- Bill proceeds of the export LC (Selling LC) will be used to meet liabilities under the second (Buying LC)

- Amount of back to back credit will be lower.

- Usance period of the back to back credit should be equal to or more than that of the export credit.

- Bank still at risk if the customer fails to export

- No concession in margin and security norms.

- Credit is opened to cover a series of regular transactions over a longer period

- Beneficiary will submit a series of documents

- Maximum value of each document will be fixed and is the revolving limit

- LC amount is the maximum value of documents that can be handled under the credit.

- The credit may be reinstated automatically or after payment of earlier bill.

- It can be opened as cumulative or non cumulative.

- Credit is issued for a particular amount and for a particular period

- Trade takes place on running account basis.

- Beneficiary does not submit documents to bank.

- If there is a default, he can claim funds from opening bank giving a certificate of default

- No quibbling over discrepancies and documents

- Opening bank will pay on demand

- Works like a bank guarantee

- UCPDC is applicable if so declared in the credit

- Foreign Trade Policy requirements.

- FEMA requirements.

- Credit norms of Central Bank.

- UCPDC 600 Provisions.

- Banks Internal Credit Policies/ procedures.

- Public notices issued by DGFT

- Uniform Rules for bank-to-bank reimbursements 525

- Incoterms 2010

- Issuing Bank (opening bank)

- ( UCP Article 7)

- -the prime obligator

- -to ensure credit-worthiness and trust-worthiness of the applicant

- - Once credit is opened, the bank is placing itself as a substitute for the buyer.

- Advising Bank has the obligation to authenticate the credit once it is received and passing it promptly on to the beneficiary ( Art.9).

- Confirming Bank takes over the responsibilities of the issuing bank as far as the beneficiary is concerned though it has got recourse to the Issuing Bank (Art 8).

- Negotiating Bank

- to examine docs. Within 5 banking days after receipt of the documents at their counters(Art 14b).

- to ensure compliance of credit terms ( on the basis of documents alone) as well as consistency of docs with each other.

- Banks are not responsible

- for the genuineness or contents of any documents submitted (Art. 34)

- For losses etc. arising from transmission problems (Art. 35)

- Force Majeure ( Art. 36)

- For the failings of their correspondent Banks (Art. 37)

- Issuing Bank is responsible for all Bank charges and other costs at home or abroad even if they are supposed to be paid by other party (Art. 37 c).

- Applicant is responsible for any adverse consequences of foreign laws (Art. 37d).

- satisfactory track record.

- dealings with only one bank.

- Liabilities of the applicant to the Bank and third parties.

- Means by which the applicant is expected to meet his commitment once the bills arrive.

- Margin he should deposit.

- Limit to be commensurate with turnover and CC limits.

- Should be for genuine trade/ manufacturing activity.

- Usance period of the LC should ordinarily have relation to the working capital cycle.

- Level of inventory carried should be commensurate with industry norms / past trends.

- LCs for purchase of machinery / capital goods should be backed by borrowers own funds or a term loan sanctioned for the purpose.

- Wherever warranted, in addition to margin, where prescribed, we may also retain a lien on the undrawn portion of the CC limit for the value of bills to be received under the LC.

- Sister concerns

- Where the opener and beneficiary are sister concerns, LCs should not normally be necessary.

- Take care of kite-flying operations.

- Standing of the beneficiary.

- D/A facilities to applicants of undoubted standing and where security available is much more than the value of LC.

- While computing purchase of imported material on LC basis take net of import duty.

- Assess limits for usance and sight LC separately.

- Usance period should not exceed the production cycle excepting in the case of bulk imports.

- Keep in mind the accepted projections regarding Sundry Creditor levels.

- Margins security depending on track record.

- Cash budget monitoring to track availability of funds.

- Revolving LCs

- To be valid for not more than 1 year

- The limit should be a sub-limit.

- The LC value should be restored for further negotiation only after the advice of retirement of the previous bill has been received from the issuing bank by the beneficiary bank.

- While assessing Letter of Credit Limit, the following points need to be noted

- Purchases of RM on LC basis should be net of Import Duty LC amount should cover FOB, CIF or CF value of goods- should not include customs duty and other charges payable in India. Payment of these charges should be taken care of by the main working capital(CC) A/C of Applicant.

- Transit time should be treated as Nil if usance period starts from shipment date.

- Arriving at D.P

- Ensure that the stocks covered by bills which have been received under LCs opened by us, and not yet retired, are not included for computing the D.P. in CC account.

- Devolvement of LCs

- In case of irregularity in CC account do not open further LCs.

- Take adequate margins and step up in case of it becoming a habit in worse cases stop further issues.

- Mark lien on DP so that usance bills are properly retired on due date.

- Lien should be earmarked against advance value of stocks for the outstanding usance LC bills.

- This ensures provision of margins on the stocks covered by usance LCs right from the time the stocks are bought on credit backed by the Banks commitment.

- Thus, it ensures that the margin is available well before the CC a/c is debited for the matured LC bill.

- In some cases it is quite possible that the units may not be in a position to provide margins right from the time of purchases against LCs. In such cases, based on merits, earmarking of lien for the value of usance LC bills outstanding may be permitted against the aggregate market value of stocks (including the LC stocks) instead of against the advance value of securities.

- The limits for demand LCs and usance LCs should be assessed separately with ample justifications.

- The usance period should not, generally, exceed the production cycle.

- In case of bulk imports, establishment of LCs for longer usance period may be considered selectively.

- When liability under LC is met by creating an irregularity in the Cash Credit account, the relative LC limit should not be released for opening further LCs till the account is adjusted.

- Frequent Devolvement's Warning signal!

- We assume that

- - Annual consumption of material to be purchased under LC C (Rs..)

- Lead time from opening LC to

- shipment L (months)

- - Transit time T (months)

- - Credit (usance) period available U (months)

- L T U Purchase Cycle P (months)

- LC Limit P x C/12

- Say, lead time, i.e. time from order placement to shipment 10 days

- Transit period 20 days

- Usance period from arrival of goods 3m

- Total Purchase Cycle 4m

- Monthly consumption of material Rs 100 lacs

- LC Limit(4 x 100) Rs 400 lacs

- M/s XYZ COMPANY LIMITED

- LETTER OF CREDIT LIMIT OF Rs. 20 CRORES

- (Rs. in crores)

- Let us assume as follows (Rs in lacs)

- i) Annual purchase of RM 3200

- ii) RM purchase under LC(50) 1600

- iii) Purchase under demand LC 800

- iv) Purchase under usance LC 800

- Time gap from opening till shipment 1 m

- Transit period from date of shipment

- till date of retirement 0.5 m

- Demand LC Limit 800 x 1.5/12 Rs 100 lacs

- Lead Time, i.e from opening LC till shipment 1 month

- Transit Period, i.e. from date

- of shipment till date of receipt of documents by importer 0.5 months

- Average usance period 2 months

- Usance LC Limit 800x3.5/12 Rs 233 lacs

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

Letter of Credit

What is a Letter of Credit? Parties Involved in LC Transaction Letter of Credit Process Types of Letter of Credit Documents of Letter of Credit Advantages of Letter of Credit Disadvantages of Letter of Credit Read less

More Related Content

- 1. Letter of Credit

- 2. Table of Contents What is a Letter of Credit? Parties Involved in LC Transaction Letter of Credit Process Types of Letter of Credit Documents of Letter of Credit Advantages of Letter of Credit Disadvantages of Letter of Credit

- 3. What is a Letter of Credit? A letter of credit is an undertaking issued by a bank for the account of the buyer (applicant), to pay the seller (beneficiary) provided the terms and conditions of the letter of credit are complied with. A letter of credit usually satisfies the seller’s desire for cash payment and the buyer’s desire for credit. A Letter of Credit is also known as a Documentary Credit. It is mostly used in international trade, and it is a way of reducing the payment risks associated with the movement of goods.

- 4. Parties Involved in LC Transaction The Applicant is the party that arranges for the letter of credit to be issued. The Beneficiary is the party named in the letter of credit in whose favor the letter of credit is issued. The Issuing or Opening Bank is the applicant’s bank that issues or opens the letter of credit in favor of the beneficiary and substitutes its creditworthiness for that of the applicant. An Advising Bank may be named in the letter of credit to advise the beneficiary that the letter of credit was issued. The role of the Advising Bank is limited to establish apparent authenticity of the credit, which it advises.

- 5. Letter of Credit Process

- 6. Types of Letter of Credit Revocable & Irrevocable Letter of Credit Confirmed Letter of Credit Sight Credit and Usance Credit Back to Back Letter of Credit Transferable Letter of Credit Stand by Letter of Credit

- 7. Revocable & Irrevocable Letter of Credit Revocable: A revocable letter of credit may be revoked or modified for any reason, at any time by the issuing bank without notification. It is rarely used in international trade and not considered satisfactory for the exporters but has an advantage over that of the importers and the issuing bank. It should be indicated in LC that the credit is revocable. if there is no such indication the credit will be deemed as irrevocable. Irrevocable: In this case it is not possible to revoked or amended a credit without the agreement of the issuing bank, the confirming bank, and the beneficiary. Form an exporters point of view it is believed to be more beneficial. An irrevocable letter of credit from the issuing bank insures the beneficiary that if the required documents are presented and the terms and conditions are complied with, payment will be made.

- 8. Confirmed Letter of Credit Confirmed Letter of Credit is a special type of L/C in which another bank apart from the issuing bank has added its guarantee. Although, the cost of confirming by two banks makes it costlier, this type of L/C is more beneficial for the beneficiary as it doubles the guarantee.

- 9. Sight Credit and Usance Credit Sight credit states that the payments would be made by the issuing bank at sight, on demand or on presentation. In case of usance credit, draft are drawn on the issuing bank or the correspondent bank at specified usance period. The credit will indicate whether the usance draft are to be drawn on the issuing bank or in the case of confirmed credit on the confirming bank.

- 10. Back to Back Letter of Credit Back to Back Letter of Credit is also termed as Countervailing Credit. A credit is known as back to back credit when a L/C is opened with security of another L/C. Counter credit is actually a method of financing both sides of a transaction in which a middleman buys goods from one customer and sells them to another. Parties Involved: The buyer and his bank as the issuer of the original Letter of Credit. The seller/manufacturer and his bank. The manufacturers subcontractor and his bank.

- 11. Transferable Letter of Credit A transferable letter of credit credit is a type of credit under which the first beneficiary which is usually a middleman may request the nominated bank to transfer credit in whole or in part to the second beneficiary. This type of L/C is used in the companies that act as a middle man during the transaction but don’t have large limit. In the transferable L/C there is a right to substitute the invoice and the whole value can be transferred to a second beneficiary.

- 12. Standby Letter of Credit Initially used by the banks in the United States, the standby letter of credit is very much similar in nature to a bank guarantee. The main objective of issuing such a credit is to secure bank loans. Standby credits are usually issued by the applicant’s bank in the applicant’s country and advised to the beneficiary by a bank in the beneficiary’s country.

- 13. Documents of Letter of Credit Financial Documents Commercial Documents Shipped Documents Shipping Documents Transport Documents Bill of Exchange Invoice Insurance Policy Transport Documents Bill of Lading Co-Accepted Draft Packing List Insurance Certificate Airway Bill Commercial Documents Truck/Lorry Receipt Legal Documents Railway Receipt

- 14. Advantages of Letter of Credit For Exporters: Reach out New Customers: Establishing a new business connection is not easy. It is difficult to find a new buyer who is ready to make an advance payment to an untested exporter. By offering a letter of credit, the exporter can increase the chance of securing the order. Increasing Export Coverage: Exporters can increase their export coverage by regional means if they can effectively use letters of credit. For example, letter of credit is the main payment option for majority of the Middle East countries. Mitigates Default Risk of the Importer: By using a letter of credit, the exporter can replace default risk from the importer to the importer’s bank, because the letter of credit is a conditional payment undertaking of the issuing bank. Eliminates Importing Country’s Political Risks via Confirmation: By adding confirmation, the exporter can eliminate importing country’s political risks, at least in theory. For further information please read our post “Confirmation and Confirmed Letter of Credit”. Discounting Possibilities: It is possible to discount letters of credit that do not payable at sight. Once the issuing bank or confirming banks determines that the letter of credit documents are complying, the respected bank can discount the credit.

- 15. Advantages of Letter of Credit For Importers: Proof of Creditworthiness: By issuing a letter of credit from a reputable bank, the importer proves that he is a financially reputable company. More Favorable Payment Terms: The importer may be able to convince the exporter to work with a deferred payment terms instead of an at sight payment via a letter of credit. As the exporter can discount the credit any time after the complying presentation, deferred payment should not a big issue for him. Most frequently used deferred payment options under the letters of credit are 30 days, 60 days or 90 days after the bill of lading date. Timely Shipments: Importers can determine the shipment period by using a letter of credit. If the exporter can not shipped the goods on time, he may face a late shipment discrepancy.

- 16. Disadvantages of Letter of Credit For Exporters: Higher Learning Costs: Letter of credit is one of the most complex fields of the international trade. Exporters acting with lack of letter of credit expertise and experience may face unpleasant consequences. Higher Bank Fees: Exporters may have to pay high letter of credit fees to the banks under different names comparing to other payment methods. Time Consuming Procedures: Letter of credit is a conditional payment undertaking of the issuing bank. The condition is known as complying presentation. Making a complying presentation is not easy and a very time consuming process.

- 17. Disadvantages of Letter of Credit For Importers: Fraud Risks: While not common, it is possible that exporters can reach to the funds under letters of credit by submitting fraudulent documents. Higher Bank Fees: Just like exporters, importers have to pay high letter of credit fees to the banks under letters of credit transactions. Risks Associated with Shipment of Low Quality Goods: It is not easy to stop payment under the letter of credit once the issuing or confirming bank determines complying presentation. The importer may have to pay for the goods not consistent with the sales contract.

- 18. THANK YOU!

IMAGES

COMMENTS

Jun 4, 2020 · 3. What is a Letter of Credit? • The Letter of Credit is a specialized, technical tool that is applied when paying for a shipment of goods or services from one party to another • A Letter of Credit is a document issued by a bank at the buyer’s request in favor of the seller; it guarantees that the buyer will pay the agreed amount of money to the seller within a specified period of time ...

Jan 13, 2014 · 4. > Introduction • Definition: – A Letter of Credit, simply defined, is a written instrument issued by a bank at the request of its customer, the Importer (Buyer), whereby the bank promises to pay the Exporter (Beneficiary) for goods or services, provided that the Exporter presents all documents called for, exactly as stipulated in the Letter of Credit, and meet all other terms and ...

Presenting our Process Letter Credit Ppt Powerpoint Presentation Slides Ideas Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Process Letter Credit. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios.

Presentation on theme: "Letter Of Credit: Definition, Types & Parties"— Presentation transcript: 1 Letter Of Credit: Definition, Types & Parties Compiled By: Janata Bank Staff College Dhaka

Presenting this set of slides with name use cases letter of credit ppt powerpoint presentation file slide download. The topics discussed in these slides are benefits, planning, growth, marketing, strategy. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Aug 23, 2014 · Letter of Credit – LC MT700 – Letter of Credit Providers. The power point presentation presented by Bronze Wing Trading L.L.C., the Letter of Credit Providers in Dubai talks about u2013 What is Letter of Credit, Steps to Avail Letter of Credit, and Letter of Credit Benefits. To know more about Letter of Credit, Watch these slides!

Jan 25, 2019 · 9. KINDS OF LETTER OF CREDIT Freely Negotiable L.C (Exporter can get payment from any bank) Special L.C (Restricted to particular bank named in the LC) Revolving L.C (Renew attar payment for the same amount) Transferable L.C (Endorsement is allowed in favor of any person) Red Clause L.C ( Provision of loan for Packing and shipment) Green Clause L.C (Loan for Packing, shipment as well as ...

Letter Of Credit A letter of credit is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the normal sense, LC is an authorization letter( recommending bank) to pay a specified person upon the completion of conditions started in letter of credit. Due to the nature of international dealings, including factors such as ...

Title: Letters of Credit Author: sba Last modified by: ADMIN Created Date: 3/10/2006 9:37:22 PM Document presentation format: On-screen Show (4:3) Other titles – A free PowerPoint PPT presentation (displayed as an HTML5 slide show) on PowerShow.com - id: 634a85-ZjVkY

Oct 20, 2019 · 7. Revocable & Irrevocable Letter of Credit Revocable: A revocable letter of credit may be revoked or modified for any reason, at any time by the issuing bank without notification. It is rarely used in international trade and not considered satisfactory for the exporters but has an advantage over that of the importers and the issuing bank. It should be indicated in LC that the credit is ...